The Consumer Financial Protection Bureau (CFPB) released a new report and analysis of data disclosed in 2020 by the Home Mortgage Disclosure Act (HMDA) in an effort to better understand the landscape of the mortgage market. The new analysis features extensive amounts of mortgage information disclosed by financial institutions, and features key information specifically relevant to the reverse mortgage industry and the Home Equity Conversion Mortgage (HECM) program.

In a year of both heightened interest and business for the reverse mortgage product, the HMDA data helps to give some additional context to the way the business has performed in relation to the broader mortgage market as well as some key metrics highlighting business realities which have been discussed a lot recently. These include the trends associated with HECM-to-HECM refinances along with a comparison between HECMs and Home Equity Lines of Credit (HELOCs).

Additionally, the reverse mortgage industry saw its wholesale channel outperform the retail channel for the first time in five months this past June, according to data compiled by Reverse Market Insight (RMI).

HMDA data: HECM outpaces HELOC

In direct comparison to the reverse mortgage market, the HELOC market appeared to trend downward in 2020 when the data was examined by the CFPB.

“The large increase in the total number of originations and applications in 2020 is driven by the increase in closed-end mortgages,” the HMDA data release said. “The number of HELOC records continued its downward trend from 2018 and the total number of HELOC originations declined from 1.042 million in 2019 to 869,000 in 2020. On the other hand, the total number of reverse mortgage originations increased from 35,000 to 43,000 year over year.”

This is generally in-line with what other reverse mortgage industry analysts have said about 2020’s increase in volume, but the fate of HELOCs may also be tied to the discontinuation of the product offering at some major lending institutions during the heaviest days of the COVID-19 coronavirus pandemic.

In mid-April of last year, JPMorgan Chase suspended its HELOC offerings in a move that was in the spirit of preparation, the organization said.

“Due to the economic uncertainty, we’re temporarily pausing new applications for home equity lines of credit,” said Trish Wexler, chief communications officer for Chase consumer and community banking in an email to RMD at the time. “Customers can still tap into their home’s equity through a cash-out refinance of their existing mortgage.”

This led to some speculation by academics and professionals that a major institution pausing its HELOC offerings could give a potential advantage to reverse mortgage companies, according to Dr. Wade Pfau and Stephen Resch of Finance of America Reverse (FAR). Whether or not there is a direct relationship between Chase’s decision to suspend HELOCs and the increase in reverse mortgage originations is impossible to say, however.

Top 10 reverse mortgage lenders

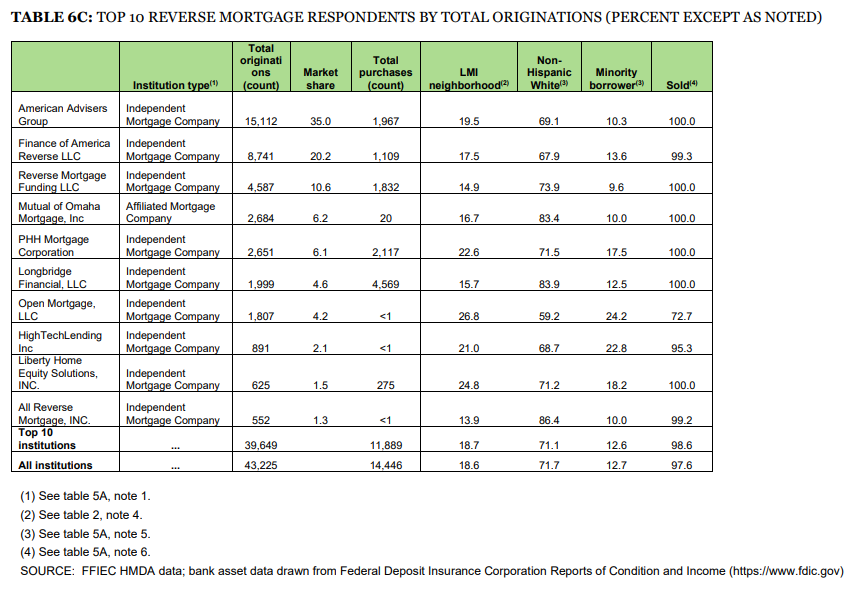

The CFPB analysis of HMDA data also took a closer look at the top 10 lenders operating in the reverse mortgage space.

“In total, the top 10 reverse mortgage lenders accounted for 39,649 reverse mortgage originations, or approximately 91.7%, of all reverse mortgage originations reported under HMDA in 2020,” the data reads. “American Advisor Group [sic] was the largest reverse mortgage lender that reported HMDA data in 2020, accounting for approximately 35.0% of all reverse mortgage originations reported. It was followed by Finance of America Reverse LLC with an annual market share of 20.2%.”

Beyond AAG and FAR, the final remaining lenders in the CFPB’s top ten tabulation include Reverse Mortgage Funding (RMF); Mutual of Omaha Mortgage; PHH Mortgage Corporation; Longbridge Financial; Open Mortgage; HighTechLending; Liberty Home Equity Solutions; and All Reverse Mortgage, respectively.

Interestingly, both PHH and Liberty are subsidiaries of Ocwen Financial Corporation, with Liberty serving as a division of PHH. At the time it became housed at PHH, the lender changed its name from “Liberty Home Equity Solutions” to the simpler “Liberty Reverse Mortgage” in March of 2020, but the CFPB data still reflects the name the lender maintained at the beginning of the year. This corporate change-up likely necessitated two sets of HMDA data to be reported for this period; one from Liberty and one from PHH.

Additional HMDA data analyzing mortgage performance in 2020, including for reverse mortgages, may come from the CFPB in the future. Read the 2020 Mortgage Market Activity and Trends report at the CFPB.

June 2021: reverse mortgage wholesale channel outpaces retail for first time in several months

HECM endorsements fell by 4.2% in the month of June 2021, for a total of 4,158 loans according to the latest HECM Originators report from RMI. The fall comes in the midst of generally heightened reverse mortgage industry activity that has been taking place over the past few months as the economic impact of the COVID-19 coronavirus pandemic continues, as volume again remained above the 4,000 loan threshold for the month.

Interestingly, June marked the first time in five months that the wholesale channel outperformed its retail counterpart, with the shift being generally reflected in the performance levels of the major reverse mortgage lenders in the country. However, only three lenders in the top 10 managed to increase volume in June.

Mutual of Omaha Mortgage rose 43.5% to 333 loans, marking its highest monthly total since the 2017 principal limit factor (PLF) changes went into effect in January, 2018’s endorsements. They were followed by HighTechLending’s 10.5% bump to 95 loans, which was followed by FAR’s 0.2% bump to 622 loans for the month.

RMI President John Lunde previously detailed for RMD that the HECM Originators report is useful in seeing the splits in and health of the retail versus wholesale channels, which helps to illustrate how lenders are doing from a more individualized and channel-specific perspective.

Read the HECM Originators report at RMI for specific breakdowns and regional performance data.