It’s been nearly two months since the number of borrowers who need forbearance on their mortgage began spiking due to coronavirus shutdowns, but it looks like the forbearance curve may be flattening.

New data from the Mortgage Bankers Association shows that the overall rate of forbearance is still on the rise, but the rate at which that figure is increasing has slowed to the lowest level since the crisis began.

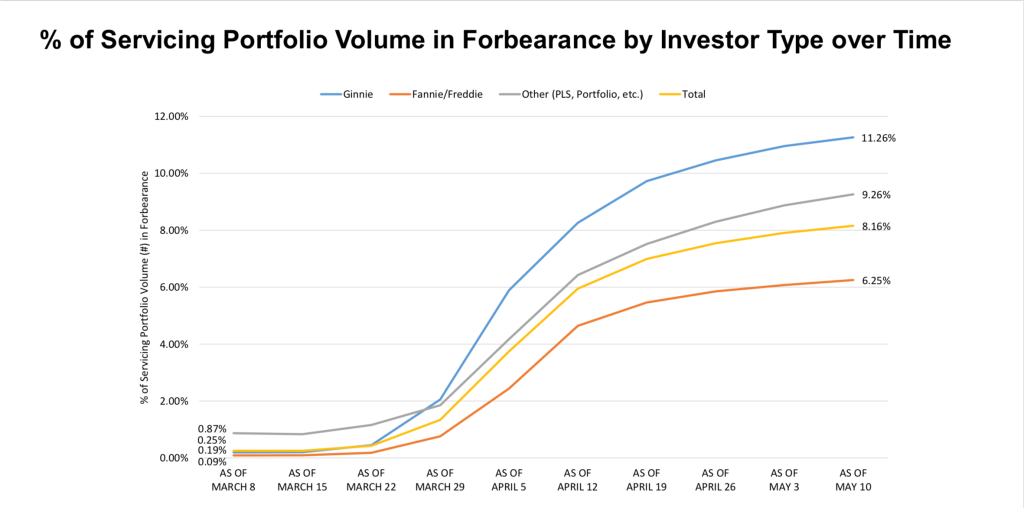

According to the MBA, the total number of loans now in forbearance rose to 8.16% during the week ending May 10, up from 7.91% in the previous week.

But the MBA notes that the 25-basis-point increase in borrowers taking forbearance is the smallest weekly increase since the week of March 16, suggesting that the economy may be starting to reawaken after the shutdowns.

“The pace of forbearance requests continued to slow in the second week of May, but the share of loans in forbearance increased,” said Mike Fratantoni, MBA’s chief economist. “There has been a pronounced flattening in loans put into forbearance – despite April’s uniformly negative economic data, remarkably high unemployment, and it now being past May payment due dates.”

As the graph below shows, the rate at which borrowers were requesting forbearance began rising in earnest in the week ending March 22. One week later, forbearance became a much more realistic option for borrowers when the CARES Act was signed into law.

Under the CARES Act, homeowners with federally backed mortgages can request forbearance for as many as 12 months.

And as the country’s economic condition worsened, more borrowers began requesting forbearance, leading to a spike that was seen throughout April.

But, the MBA data shows that things may be beginning to slow down. According to the MBA, forbearance requests as a percentage of servicing portfolio volume declined across all investor types for the fifth consecutive week.

As the MBA notes, the overall rate of forbearance did still rise to 8.16%, meaning approximately 4.1 million homeowners are in forbearance.

Broken down by investor type, the share of Ginnie Mae loans (those insured by the Federal Housing Administration or Department of Veterans Affairs) in forbearance increased from 10.96% to 11.26%.

Meanwhile, the share of Fannie Mae and Freddie Mac loans in forbearance rose from 6.08% to 6.25% and the share of other loans (private-label securities and portfolio loans) in forbearance increased from 8.88% to 9.26%.

But Fratantoni noted that there are positives found in the most recent data that indicate improvement could be coming.

According to Fratantoni “record-low mortgages rates are sustaining the refinance wave, helping homeowners lower their mortgage payments and save money during these challenging times.”

Beyond that, Fratantoni said that the recent increases in purchase applications are a sign that housing demand is strengthening as more states ease restrictions on activity and people get back to work.

“We will continue to closely monitor the forbearance request and call volume data for any sign of an uptick, but current trends suggest that if the economy continues to gradually reopen, the situation could be stabilizing,” Fratantoni added.