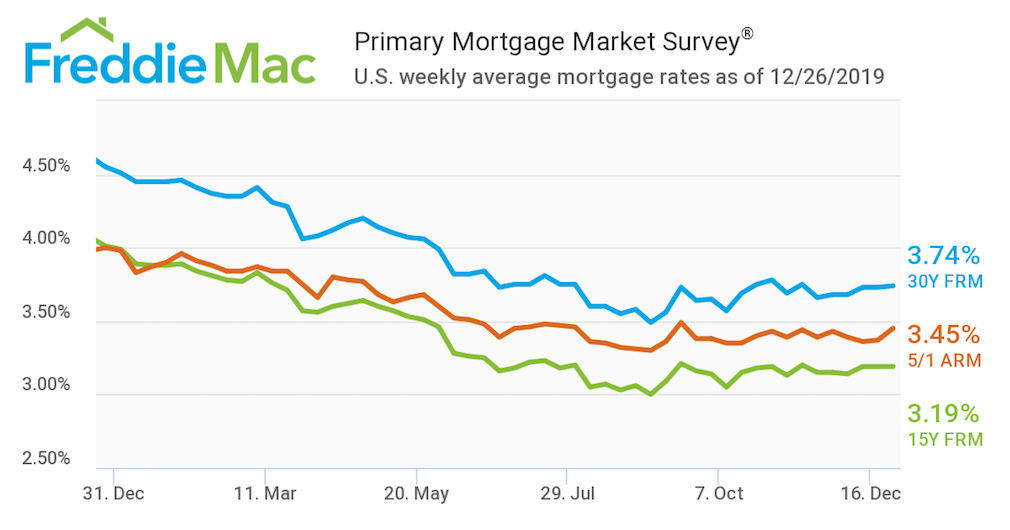

This week, the average U.S. fixed rate for a 30-year mortgage held steady at 3.74%. Although this rate remains unchanged from last week’s percentage, it’s still well below the 4.55% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

This week, the 15-year FRM averaged 3.19%, remaining unchanged from last week’s rate. This time last year, the 15-year FRM came in at 4.01%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.45% this week, rising from last week’s rate of 3.37%. Last year, the 5-year ARM averaged 4%.

Sam Khater, Freddie Mac’s chief economist said throughout 2019, mortgage rates have averaged just 3.9%, marking the fourth-lowest annual average level since 1971, which is when Freddie Mac started its weekly survey.

As the year comes to an end, Khater claims the nation’s low mortgage rates and healthy economy will champion growth within the housing market next year.

“Heading into 2020, low mortgage rates and the improving economy will be the major drivers of the housing market with steady increases in home sales, construction, and home prices,” Khater said.

However, he warns that housing affordability, which has been a major cause of concern for homeowners across the country, will continue to pose a threat in 2020.

“While the outlook for the housing market is bright, worsening housing affordability is no longer a coastal phenomenon and is spreading to many interior markets and it is a threat to the continued recovery in housing and the economy,” Khater said.

The image below highlights this week’s changes: