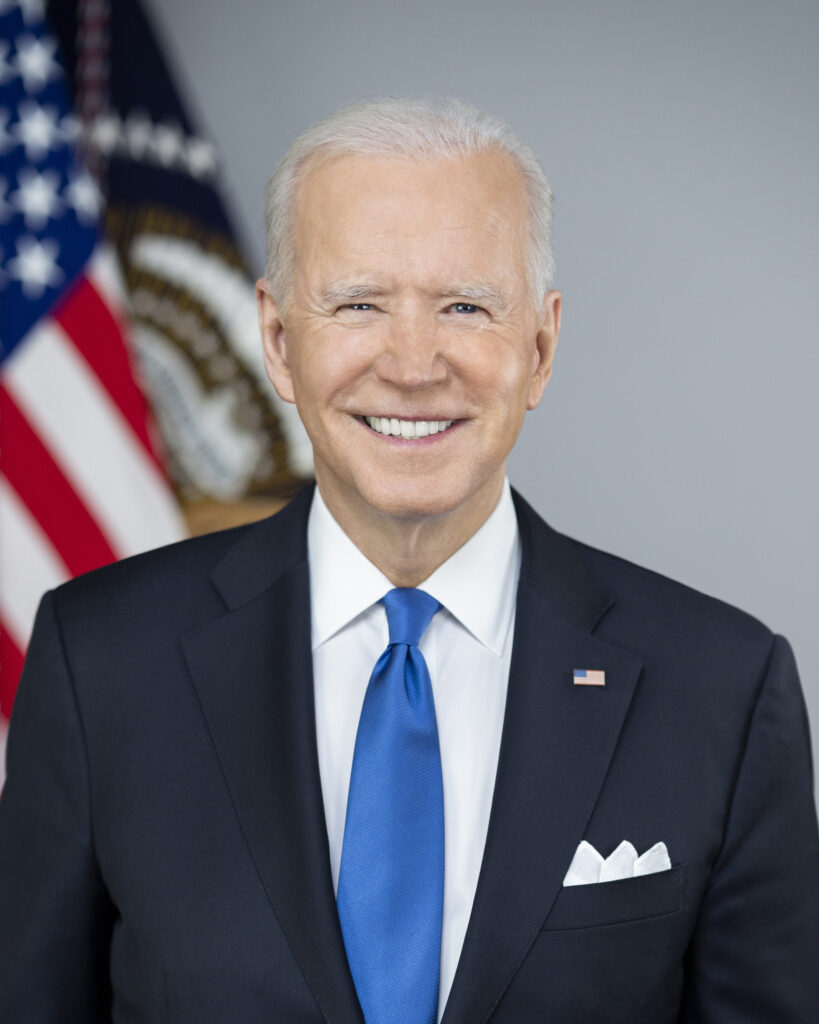

The administration of President Joe Biden submitted its fiscal year 2022 federal budget proposal to Congress on Friday afternoon, headlined by a $6 trillion figure featuring an abundance of new spending programs aimed at hastening the economic recovery of the United States after enduring the effects of the COVID-19 coronavirus pandemic.

However, the legislative and provisional proposals outlined in the Department of Housing and Urban Development (HUD)’s congressional justifications for the White House’s budget proposal specific to the FHA Fund helps to provide insight into the new administration’s perspectives on the Home Equity Conversion Mortgage (HECM) program, and where its strengths and weaknesses lie relative to the perspectives of the previous administration.

The recent federal budget proposal crucially indicates that the request of $180 million for the Mutual Mortgage Insurance (MMI) Fund is for Federal Housing Administration (FHA) administrative contract expenses; an expansion of the Good Neighbor Next Door (GNND) Program; and a new Home Equity Accelerator Loan (HEAL) pilot. This accounts for an additional $50 million over the enacted levels seen the prior year, which FHA attributes first to increased costs for FHA mortgage servicing, largely singling out HECM servicing.

Biden budget for MMI Fund, HECM program

Most of the increase in the requested figure for the MMI Fund appears to be attributed to higher costs associated with HECM servicing, according to the congressional justifications document released by HUD in conjunction with the administration’s budget.

“The primary cause of the increase is the growing expense of servicing the Secretary-held HECM portfolio,” the document reads. “In addition, due in part to the increased volume of partial claims in response to COVID-19 and disasters, the Secretary-held mortgage servicing portfolio continues to grow. FHA anticipates expending significantly more resources to service these mortgages and to dispose of the properties once they become vacant.”

Additionally, the budget also requests $400 billion in loan guarantee commitment limitation, which “includes sufficient authority for insurance of single-family forward mortgages and HECMs,” the document says. This figure remains unchanged from the request made in the Trump administration’s final budget proposal submitted last February.

Comparison with prior administration

One place in which the Biden administration clearly differs from its predecessors is in HECM-related legislative proposals for the MMI Fund. In the 2021 budget proposal, HUD as led by Secretary Ben Carson proposed several different legislative remedies for the HECM program.

These included the institution of regional HECM lending limits; a “spousal survival” provision to exempt lenders who would otherwise be required to immediately foreclose upon a living spouse; an update to the actuarial analysis formulated in 2001 that FHA uses to determine the adequacy of its HECM insurance premiums; the permanent removal of the limitation placed on the number of HECMs that can be insured by FHA; and a waiver of the HECM counseling requirement to provide HUD with the authority to mandate counseling for all HECM transactions.

By a direct contrast, the document accompanying the Biden HUD budget document offers no legislative proposals for the HECM program inside the MMI Fund, even though the new administration credits the increased costs associated with HECM servicing as driving the need for an additional $50 million in the Fund’s budget.

However, another area of impact on the HECM program is in HUD’s Office of Housing Counseling, and the Biden administration appears to value the services of that office more than its predecessors in terms of raw dollars requested. In the 2021 document, the Trump HUD requested $45 million for housing counseling programs, which accounted for $8 million less than the 2020 enacted level. In the case of the Biden HUD, the new request is nearly double the last request of the previous administration at $85.9 million.

The Biden HUD is also seeking an additional $20 million over the Trump HUD for grants to housing counseling agencies and fraud/scam awareness/prevention and training, requesting $61.4 million to the Trump HUD’s request of $40.5 million. Both the current and prior administrations requested $4.5 million for administrative contact services, which includes the funding of HECM tools for housing counselors.

Adding to the full request in the Office of Housing counseling is a $20 million request for a new Legal Assistance Grant Program, which is designed to prioritize outreach and assistance to eligible low-income tenants in historically underserved populations facing eviction proceedings, largely stemming from housing instability caused by the effects of the pandemic.

Some original relief measures introduced by the Trump administration have been carried over into the Biden administration, including a re-extension of foreclosure and eviction moratoriums as well as the ability to complete exterior-only appraisals. However, HUD Secretary Marcia Fudge described in a statement where the priorities of HUD under her leadership remain, and how the president’s budget proposal reinforces those priorities.

“With the FY22 Budget, we are turning the page on decades of disinvestment and disregard for our nation’s housing crisis and putting housing where it belongs – at the center of our efforts to build a stronger, more equitable America,” said HUD Secretary Marcia Fudge in a statement accompanying the release of the budget proposal. “The Budget sends a clear signal that HUD is no longer going to be left on the sidelines while millions of Americans struggle with housing and remain shut out from the opportunities a good home provides. The FY22 Budget transforms and empowers HUD to lay the foundation for stronger, more equitable housing infrastructure, to help communities thrive, and to give every person a fair shot to get ahead.”

NBS action already taken, servicing issues

While the Trump administration made a legislative proposal last year to address issues related to HECM non-borrowing spouse (NBS) scenarios, the Biden HUD has already taken its own action separate from the lawmaking process to address this issue.

A few weeks ago, FHA announced four primary new protections for eligible NBS in a reverse mortgage transaction, including the expansion of criteria that begins a deferral period for HECM loans with case numbers assigned on or after August 4, 2014, including for a scenario in which the primary borrower resides in a healthcare facility for more than 12 consecutive months but the NBS has remained in the home. Separate protections were also instituted for HECMs with case numbers assigned prior to August 4, 2014, including new due and payable criteria.

The new NBS provisions were largely welcomed by members of the HECM servicing industry including from representatives of Celink and Reverse Mortgage Solutions (RMS), as well as the National Reverse Mortgage Lenders Association (NRMLA) based on RMD’s outreach.

HECM servicing by FHA has long been a contentious issue in debates stemming from the health of the reverse mortgage program inside the MMI Fund. In an interview earlier this year with RMD, Former Deputy HUD Secretary Brian Montgomery described the need to address HECM servicing issues.

“[I]t’s no mystery that the industry and FHA always need to work together on a lot of different issues, including reducing the cost of servicing the assigned portfolio, or always looking for ways to improve the property disposition process,” Montgomery told RMD in February. “Certainly, there’s an interest in the industry around allowing servicers to retain servicing at the 98% threshold, and I can certainly understand their perspective on it.”

Earlier this year, NRMLA submitted comment letters to HUD regarding HECM servicing, and HUD also previously revised single-family mortgage servicing and loss mitigation policies on both the forward and reverse sides of the business, including the codification of new reverse mortgage policies as well as the either outright or partial rescinding of certain Mortgagee Letter (MLs) that have application to the HECM program.