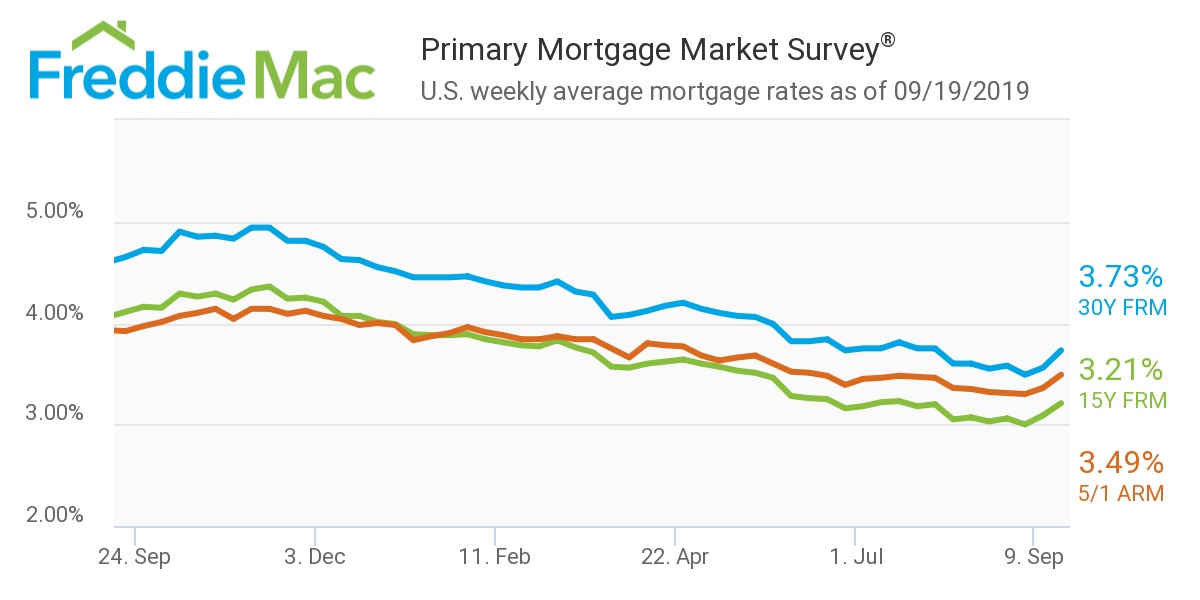

This week, the average U.S. fixed rate for a 30-year mortgage rose to 3.73%. That's seventeen basis points above last week’s 3.56% but almost a percentage point lower than the 4.65% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

According to the GSE, this week’s 30-year fixed mortgage rate increase is the largest weekly uptick since last October.

Despite the rise in mortgage rates, economic data improved this week – particularly housing activity, which gained momentum with a noticeable rise in purchase demand and new construction, said Freddie Mac Chief Economist Sam Khater.

“Homebuyers flocked to lenders with purchase applications, which were up 15% from a year ago and residential construction permits increased 12% from a year ago to 1.4 million, the highest level in twelve years,” Khater said. “While there was initially a slow response to the overall lower mortgage rate environment this year, it is clear that the housing market is finally improving due to the strong labor market and low mortgage rates.”

The 15-year FRM averaged 3.21% this week, moderately increasing from last week’s 3.09%. This time last year, the 15-year FRM came in at 4.11%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.49%, rising from last week’s rate of 3.36%. This percentage is still a large decline from its 2018 rate of 3.92%.

The image below highlights this week's changes: