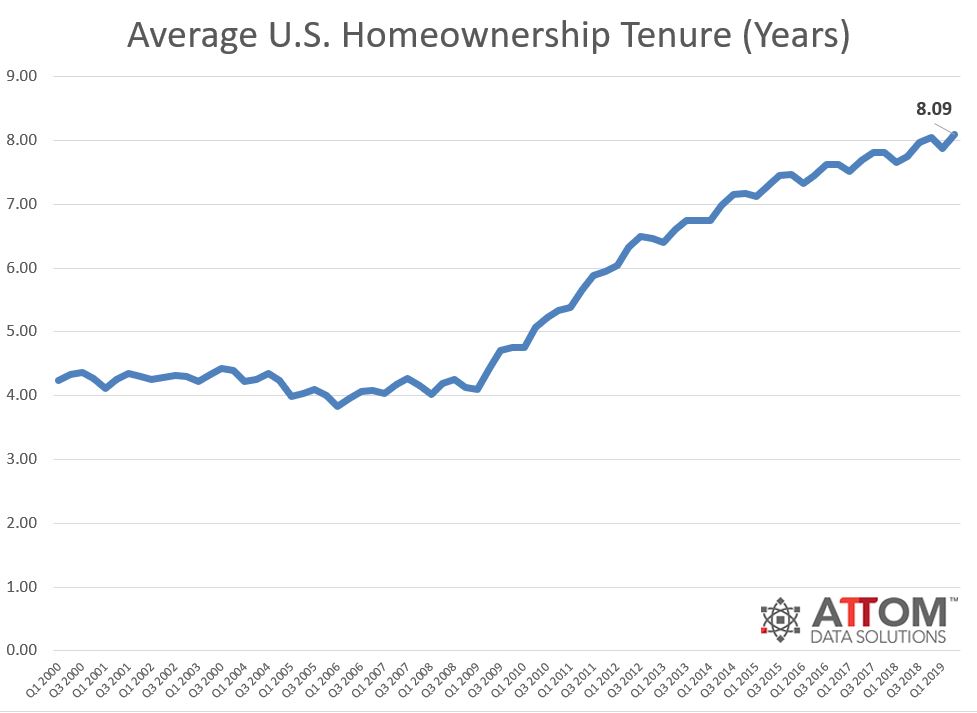

American homeowners are staying put longer than ever before, with the average tenure reaching a record high of 8.09 years in the second quarter of 2019.

This stands in stark contrast to the years leading up to the recession, as tenure from 2001-2007 averaged just 4.21 years.

According to the latest report from ATTOM Data Solutions, homeownership tenure is up 3% from last quarter and up 4% from last year.

Todd Teta, ATTOM’s chief product officer, said the fact that homeowners are opting to stay in their homes longer suggests a tightening in the market thanks to high home prices.

“Potential homebuyers are in a bit of a pickle due to the fact that mortgage rates are dipping to low levels, however home prices are still hot,” Teta said. “This is leading people to stay in their homes longer to try and wait for the market to cool.”

Several cities stood out with the highest tenures, among them San Francisco (10.26 years); Portland (9.04 years); Tucson, Arizona (8.88 years); Phoenix, Arizona (8.17 years); and Tampa-St. Petersburg, Florida (7.85 years).

That said, 26% of the 108 metros analyzed saw tenures decline despite the national trend.

Here is a chart from ATTOM illustrating the upward trend of homeownership tenure: