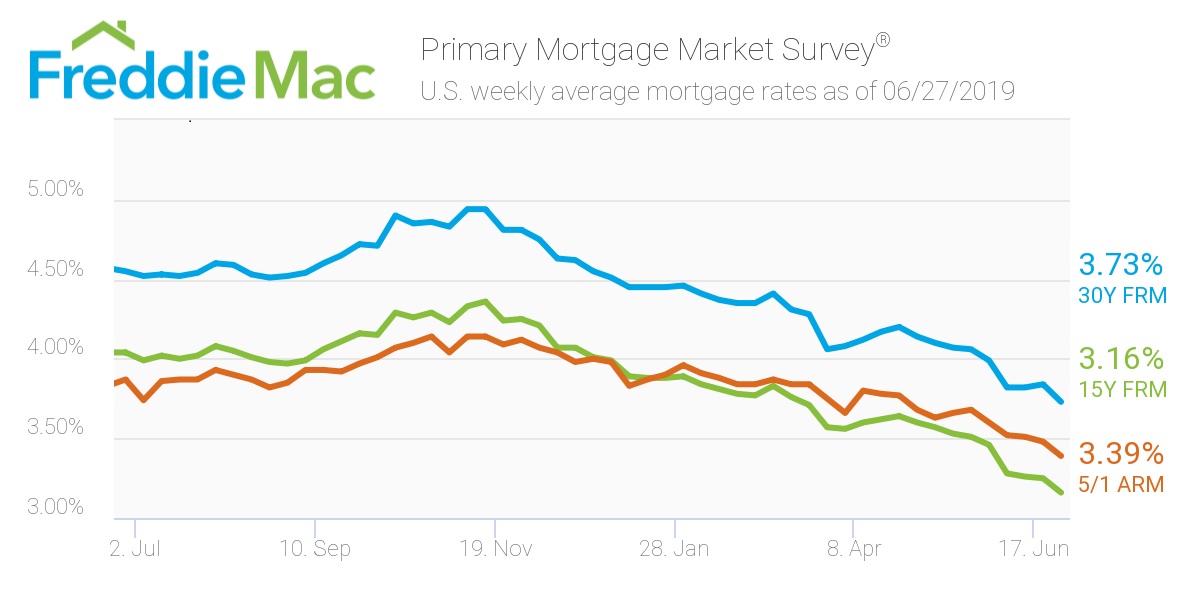

This week, the average U.S. rate for a 30-year fixed mortgage fell to a three-year low, according to the latest Freddie Mac Primary Mortgage Market Survey.

According to the company’s data, the 30-year fixed-rate mortgage averaged 3.73% for the week ending June 27 2019, down from last week’s rate of 3.84%. That's significantly lower than 2018 levels, when the rate averaged a whopping 4.55%.

“While the industrial and trade related economic data continues to dominate the news, the drop in mortgage rates over the last two months is already being felt in the housing market,” Freddie Mac Chief Economist Sam Khater said. “Through late June, home purchase applications improved by five percentage points compared to the previous month. In the near-term, we expect the housing market to continue to improve from both a sales and price perspective.”

The 15-year FRM averaged 3.16% this week, dropping from last week’s 3.25%. This time last year, the 15-year FRM came in at 4.04%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.39%, falling from last week’s rate of 3.48%. Unsurprisingly, this rate is much lower than the same time period in 2018 when it averaged 3.87%.

The image below highlights this week's changes: