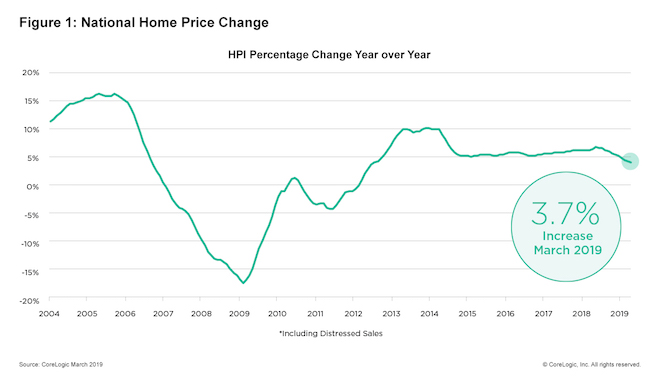

After accelerating at a steady clip for several years, home-price growth has slowed this spring as the housing market continues to cool down.

Home prices increased just 3.7% year over year in March, according to the latest data from CoreLogic, increasing by just 1% from the month before.

And, prices may continue to decelerate, as CoreLogic predicts that home prices will decrease by 0.3% from March to April.

“The U.S. housing market continues to cool, primarily due to some of our priciest markets moving into frigid waters,” said Ralph McLaughlin, deputy chief economist at CoreLogic.

But CoreLogic says things will pick up from there, forecasting a 4.8% year-over-year increase by March of 2020.

“The broader market looks more temperate as supply and demand come into balance,” McLaughlin added. “With mortgage rates flat and inventory picking up, we expect more buyers to take advantage of easing housing market headwinds.”

CoreLogic also revealed that 35% of the country’s 100 largest metropolitan areas had an overvalued housing market in March 2019, while 26% were undervalued and 39% were at value.

The company also released the results of a survey measuring consumer-housing sentiment in high-priced markets, revealing that 76% of renters and buyers in high-priced markets said housing prices are driving rental rates up.

“The cost of either buying or renting in expensive markets puts a significant strain on most consumers,” said CoreLogic President and CEO Frank Martell. “Nearly half of survey respondents – 44% of renters – cited the cost to rent in high-priced housing markets as the No. 1 barrier to entry into homeownership. This is potentially forcing renters to wait longer to have the necessary down payment in these communities.”