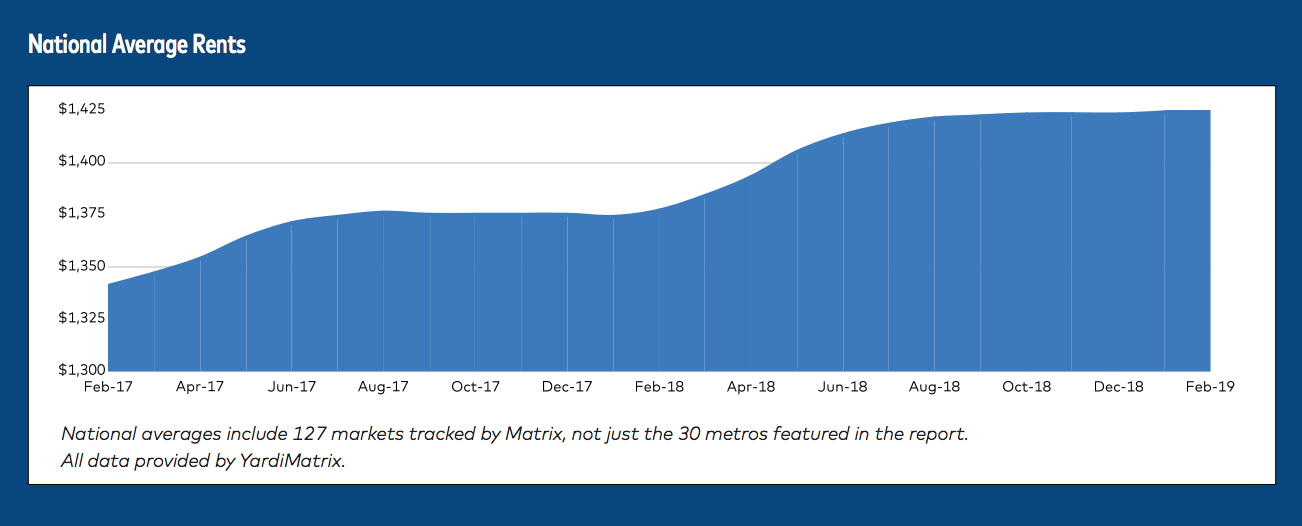

Average multifamily rents increased $2 in February to $1,426, according to the latest Yardi Matrix National Multifamily Report.

Annually, this means rent has grown 3.6%, the highest increase since late 2016, according to the report, which surveyed 127 major U.S. real estate markets.

The report shows that demand isn’t showing any signs of slowing down, bolstered by low unemployment and growing wage growth. Yardi’s analysis explained that the demand is the highest in metros with strong population gains and healthy job growth.

Rent growth has steadily risen since it bottomed out at 2.2% in the fall of 2017, according to Yardi, which noted that “the consistent growth is a sign of the strength of the sector’s fundamentals and an indication that the cycle has a ways to run.”

From the report:

The staying power of the cycle is a major concern in a market that has had an unusually long run without a downturn. Multifamily, however, continues to defy those worries, and the latest numbers are evidence that the market has strength to perform well for a while, even if the economy or other commercial real estate segments slow down.

The markets with the most rent growth in February are Phoenix, Las Vegas, Sacramento, Calif., Atlanta and California's Inland Empire. Check out the chart below to see how rent has changed year over year (click to enlarge, image courtesy of Yardi).