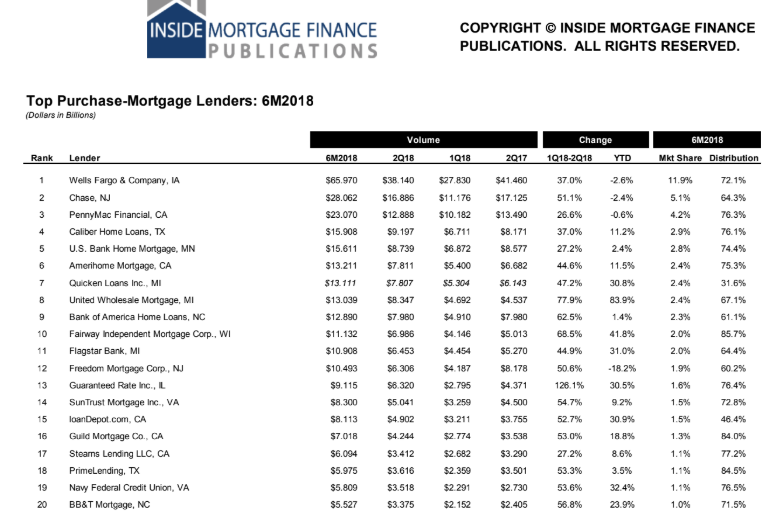

United Wholesale Mortgage continues the rapid growth of its total loan production volume, passing Quicken Loans and Amerihome Mortgage in the second quarter, according to a report by Inside Mortgage Finance.

UWM produced $11.2 billion in loan volume during the second quarter, with $8.3 billion of its business (74%) being attributed to new home purchases – compared with Quicken Loans and Amerihome, which both did $7.8 billion.

In the first quarter both Quicken and Amerihome produced more than UWM, by way of comparison. For the second quarter, only PennyMac Financial and Caliber Home Loans surpassed UWM in nonbank loan production.

Click the chart to see the top 20 rankings.

“This is a major accomplishment for us at UWM, and highlights the efforts of more than 2,700 team members here who are dedicated to helping our mortgage broker clients be the hero to their borrowers and the realtors they work with,” said Mat Ishbia, president and CEO of United Wholesale Mortgage.

“The high amount of purchases going through the mortgage broker channel reinforces that borrowers don’t want to communicate with a call center loan officer that is 1,000 miles away, or use an app that is more sizzle than substance. They prefer local, they want an expert, and they want the process to be fast and easy – and that’s what mortgage brokers provide.”

Recently, Quicken and UWM became embroiled in an epic battle for borrowers, pitting the retail giant against the brokerage titan. The war still rages.