Many of America’s retirees believe they don’t need a reverse mortgage. For now, they may be right. They may have an ample pension and strong savings. But no one would deny there are financial clouds on the horizon. A HECM line of credit can change uncertainty into certainty in a very volatile home value market. For most retirees, home equity is a substantial part of their net worth. In this article, I will share how I explain to potential clients the value of getting a HECM line of credit now, before they truly need it, so they will be better protected in the future. If you explain this correctly, your clients may come to understand that an ounce of prevention is worth a pound of cure.

Loan officers often talk to potential clients about the “lifeboat strategy.” Let’s say you are going on a cruise and the ships you are choosing between are identical, but one ship charges $950 for the week and the other $900. The only difference is that the more expensive ship has lifeboats while the other does not. Despite the fact that it is unlikely that you would need the lifeboats, few of us would think twice about spending the extra 4 to 5 percent for the safety of the lifeboats. To set up a HECM Standard ARM, it will usually cost a borrower about the same percentage in closing costs. That can scare away potential borrowers and cause

them to wait until they “need” it. We explain to our clients and their financial planners that they should not enter retirement without a HECM lifeboat. After all, the best time to get an umbrella is before the rain begins.

Retirement can be a long and sometimes difficult journey. Potential problems can arise, like health care expenses, decreasing bond values, fluctuating stock markets and decreasing home prices. No matter how well planned, retirement can be rather unpredictable. Fortunately, reverse mortgage loan officers can bring certainty to one of the biggest uncertainties in the last several years: the value of home equity. It is impossible to predict exactly what you can sell your home for a year from now, to say nothing about 20 years from now. But, because of the increasing credit line feature of the HECM ARM products, we can guarantee an increase in your access to your home equity (in cash) for years to come, regardless of what happens to the underlying value of the home, inflation and all other financial indicators.

If you are 62, just retired and looking forward to a long retirement, this should be a lifeboat you employ to help ensure a safe retirement journey. It is impossible to know exactly how much your real estate taxes, health insurance, utilities costs and life insurance will be in the future. Establishing a line of credit on your home equity that can be accessed if and when it is needed, is simply a prudent thing to do when there are so many uncertainties.

In the example graph shown above, taken from Generation Mortgage’s nu62 software, the purple line represents the potential line of credit established at age 62 if it is not drawn on for 20 years. The green line represents the potential home value based on Moody Analytics parameters. The pink line represents the cost of setting up a reverse mortgage and not paying for any of the closing costs out of pocket. This example shows a client with a $500,000 home that can secure a $250,000 line of credit for a 62-year-old borrower. This theoretical borrower has enough savings lined up so he doesn’t need to tap the credit line for the first 20 years. Based on the projections, when the borrower reaches 82, he will have more than $1.1 million in an available (tax-free) credit line.

Think of the possibilities! If health care challenges arise or if the stock market has a long slide like it did in 2008, the borrower will be covered. If the borrower wants to gift money to his children or travel around the world, these options are now possible. By making this smart decision 20 years ago, when he was 62, this borrower now has access to a significant sum to help him navigate his retirement years—and he doesn’t have to sell his house! He can still live there for the rest of his life. What informed financial planner would not want to discuss this with his wealthy clients, those who never thought about using a reverse mortgage because they didn’t “need” it?

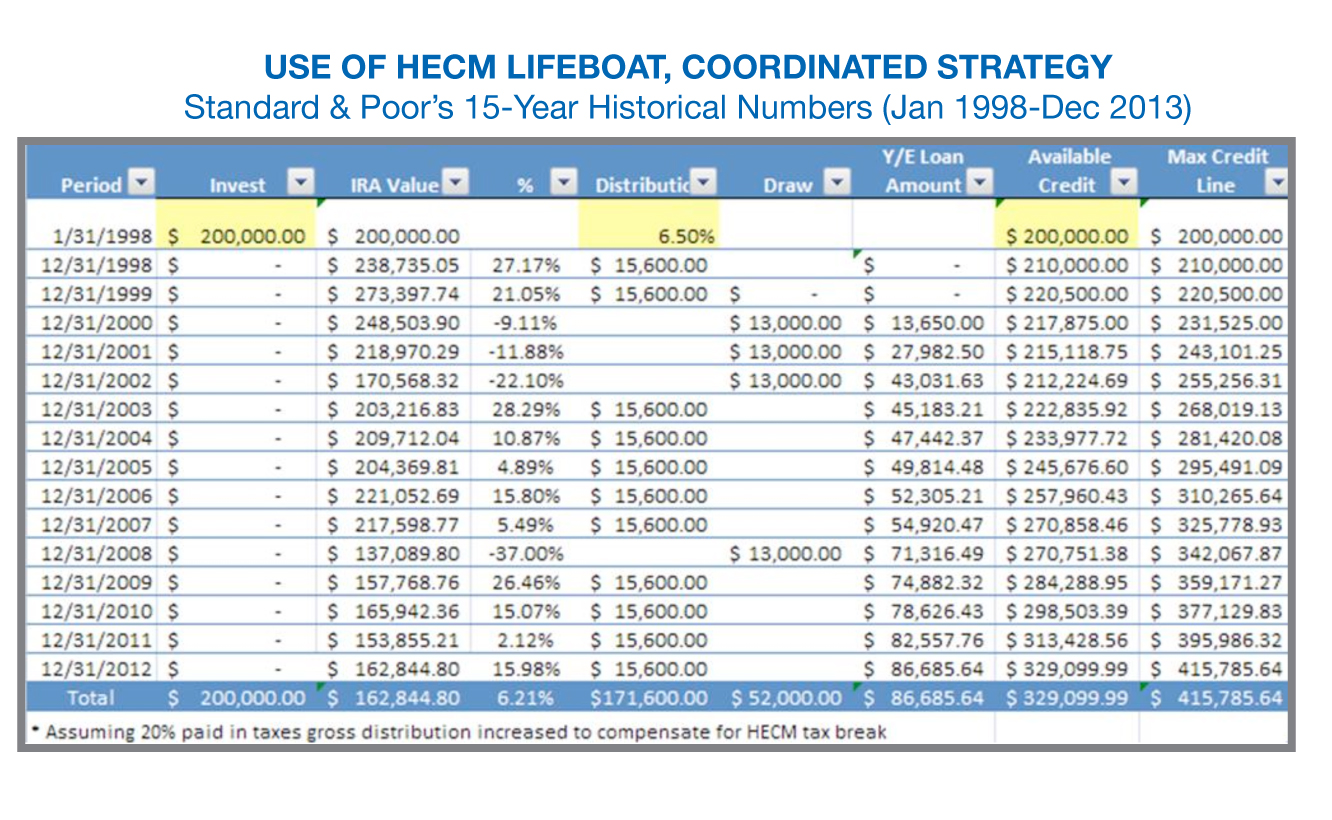

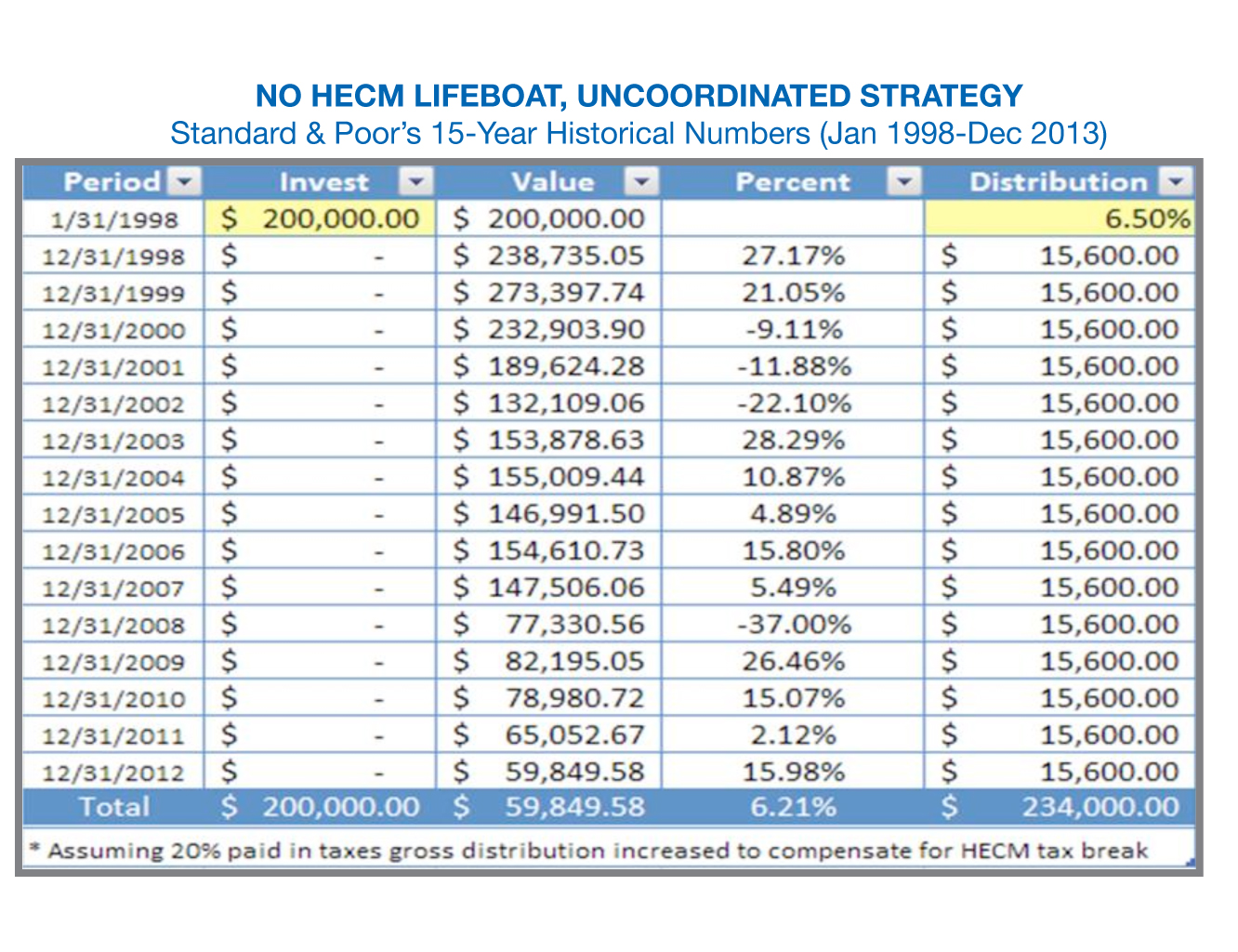

When I explain this concept to potential clients, I use a very simple pair of Excel spreadsheets that show the last 15 years of S&P investment returns (shown below). It illustrates the coordinated strategy that the Sacks brothers wrote about last year in the Journal of Financial Planning. There were four down years over the last 15 years in the stock market. We simply show the distributions being drawn from the line of credit instead of from the IRA when the market turns negative for those four years. In the typical $200,000 account that we use for an example, the client would have $170,000 left after 15 years based on a 6.5 percent draw if they drew from a HECM line of credit during those four down years. Comparatively, the client would have only $59,000 left if they drew from the IRA. Furthermore, they would have increased liquidity because they used only a part of their HECM line of credit in those 15 years.

The bottom line is that we need to get the word out to our local financial planners and our prospects that a reverse mortgage is NOT a loan of last resort but a wonderful financial tool that can create certainty out of uncertainty by utilizing what is often a retiree’s largest asset: home equity. Taking a lifeboat along on your retirement journey, even if you don’t think you will need it, is simply a wise and prudent financial decision. Make sure your clients don’t miss the boat!