Gross Domestic Product continued its growth surge in the third quarter, even as experts predicted it to fall, according to the advanced estimate from the Bureau of Economic Analysis.

Real GDP increased to an annual rate of 3% in the third quarter, according to the advanced estimate. This is down slightly from the 3.1% growth seen in the second quarter.

The third quarter advanced estimate is based on source data that is incomplete or subject to further revision, and will be followed by a second estimate released in November.

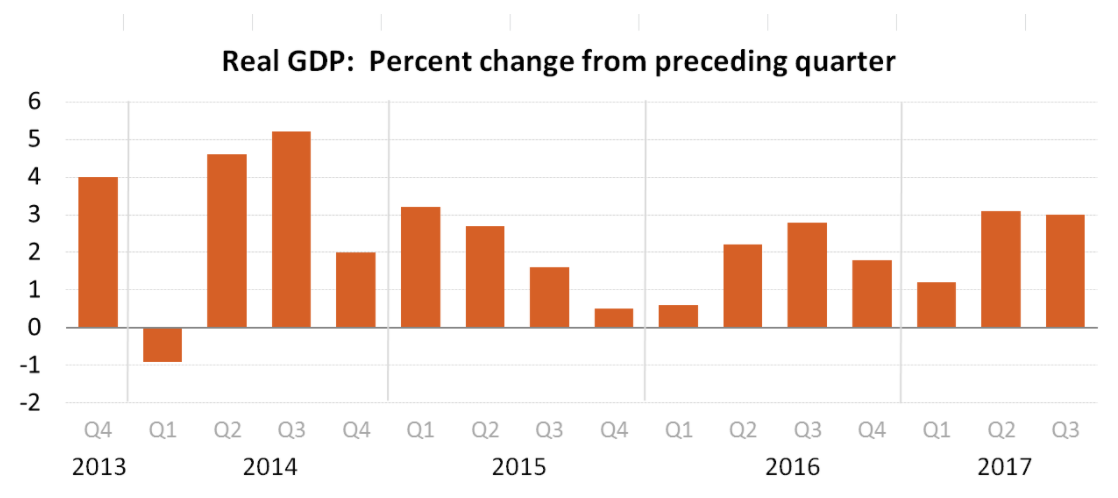

The chart below shows that, after a rough start to 2017, the year’s GDP grew to and held steady at or above a 3% growth rate for the first time since 2015. In fact, it was the first time two consecutive quarters hit the 3% mark since the second and third quarters of 2014.

Click to Enlarge

(Source: BEA)

This growth comes after Goldman Sachs reduced its forecast to reflect growth of just 2% in the third quarter due to hurricanes Harvey and Irma. The company explained the growth would soon pick up again, but at a rate of 2.7% in the fourth quarter and 2.5% in the first quarter of 2018.

“The 3% annualized gain in third-quarter GDP, which was almost unchanged from the 3.1% increase in the second, will be welcomed by the White House and demonstrates that the hurricanes ended up having little lasting impact on the economy,” Capital Economics Chief Economist Paul Ashworth said. “That was above the 2.5% consensus forecast and even our own more upbeat 2.8% estimate.”

When President Donald Trump took office, one of his promises was to create 25 million new American jobs and bring gross domestic product growth up to 4% annually. Now, it seems he could be on track to do just that on the GDP front.

But one expert disagrees, saying while GDP may increase this year and in 2018, 2019 will see a slowdown in growth.

“GDP growth for 2017 as a whole is currently tracking at around 2.1% and, assuming we see a modest fiscal stimulus in early 2018, we expect GDP growth to accelerate to 2.5% next year, even after allowing for a more aggressive pace of monetary tightening,” Ashworth said. “However, 2019 could be a very different story. We expect GDP growth to slow to only 1.5%.”

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures, private inventory investment, nonresidential fixed investment, exports and federal government spending. However, these increases were partly offset by negative contributions from residential fixed investment and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

Current-dollar GDP increased 5.2% or $245.5 billion in the third quarter to a level of $19.5 trillion. This is up from the second quarter’s increase of 4.1% or $192.3 billion.

The gross domestic price purchase index increased 1.8% in the third quarter, up from an increase of 0.9% in the second quarter. Personal consumption expenditures increased 1.5%, up from an increase of 0.3% last quarter.

However, despite these increases, one expert pointed out the real estate industry saw unwelcome declines.

“What was missing in the growth was real estate construction,” said Lawrence Yun, National Association of Realtors chief economist. “Private commercial building construction spending fell by 5.2% and residential real estate spending from new home construction and home sales activity declined by 6%.”

“This soft construction activity assures continuing tight inventory conditions, and certainly no oversupply concerns in both commercial and residential real estate,” Yun said. “If real estate activity can kick higher, since more construction is clearly needed, than it’s expected that economic growth can move at an even higher rate.”