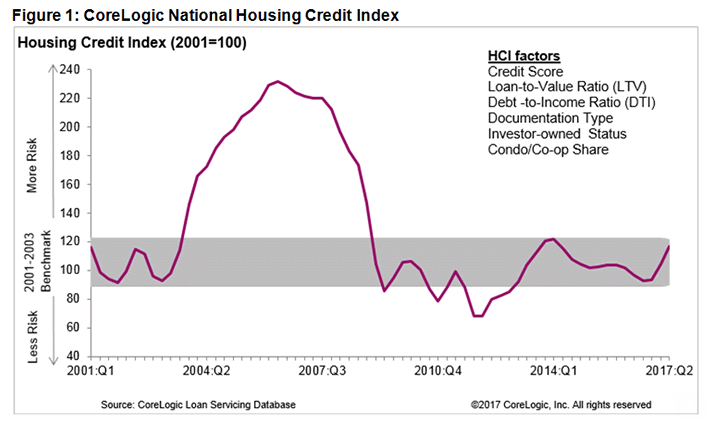

During the second quarter this year, the risk in mortgage lending inched up as the market shifted toward an increased share of investor loans, according to the Q2 2017 Housing Credit Index released by CoreLogic, a global property information, analytics and data-enabled solutions provider.

The index increased to 117 during the second quarter, up a full 20 points from the second quarter last year. However, even after this increase, the credit risk in the second quarter is still within the levels seen from 2001 to 2003, a timeframe that is considered to be a normal baseline for credit risk.

The chart below shows that while mortgage risk remains at the 2001 to 2003 benchmark level, it has been increasing since 2016, and if the trend continues, could soon surpass these levels.

Click to Enlarge

(Source: CoreLogic)

This loosening was mainly due to a shift toward more investor and condominium loans, which offset lower risk attributes such as positive advancements from credit scores, debt-to-income levels and loan-to-value ratios.

“Mortgage risk for new originations increased modestly in the second quarter of 2017, but much of this rise was due to a small shift in the mix of loan types to more investor and condominium loans, which have slightly higher risk attributes,” CoreLogic Chief Economist Frank Nothaft said. “Despite the somewhat higher risk of new origination loans, purchase mortgage underwriting remains relatively clean with an average credit score of 745 and low delinquency risk.”

The index measures trends in six areas of mortgage lending including credit score, DTI, LTV, investor-owned status, condo and co-op share and documentation level.

Here are the changes to the six attributes from the second quarter 2016 to the second quarter this year:

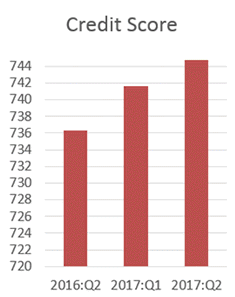

1. Credit Score:

Credit scores increased an average of nine points from last year, increased from 736 to 745. In fact, the share of homebuyers with credit scores less than 640 dropped to 2%. This is down from 25% of homeowners in 2001.

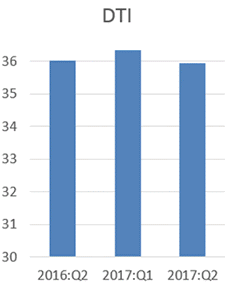

2. Debt-to-Income:

Average DTI remained unchanged from last year at 36%, and 22% of homebuyers had a DTI at or above 43%, down slightly from 25% of homebuyers last year.

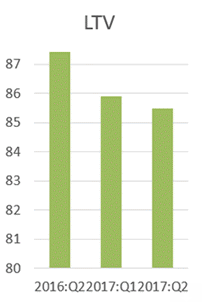

3. Loan-to-Value:

LTV dropped slightly as it lagged the second quarter of 2016 by nearly two percentage points, down from 87.4% to 85.5%. The share of homebuyers with an LTV greater than or equal to 95% is up 50% from 2001.

4. Investor Share:

The investor share of home-purchase loans increased from 3.6% last year to 4.2% in the second quarter of 2017.

5. Condo/Co-op Share:

The share of mortgages secured by a condo or co-op building increases as well, hitting 11.1%, up from 9.6% last year.

6. Documentation Type:

Low or no documentation loans remained a small share in the mortgage market, but increased slightly from 1.5% to 1.7% of home purchase loans from last year.