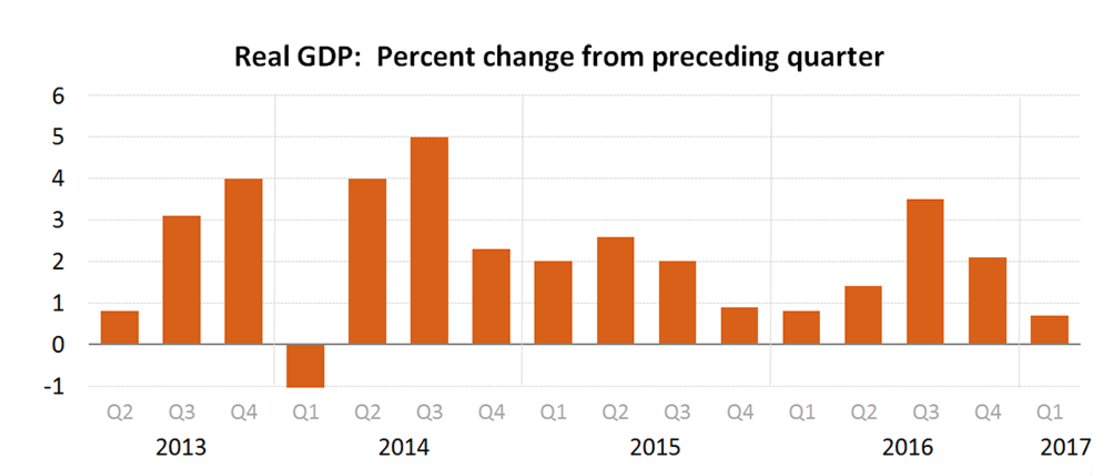

Real gross domestic product showed a disappointing increase in the first quarter with the worst growth in three years, according to the advance estimate released by the Bureau of Economic Analysis.

Real GDP increased 0.7% in the first quarter, compared to the fourth quarter’s increase of 2.1%, according to the estimate.

The first quarter advanced estimate is based on source data that is incomplete or subject to further revision, and will be followed by a second estimate released in May.

Click to Enlarge

(Source: BEA)

This chart shows this is the second consecutive quarter to see declines in GDP, down from 3.5% in the third quarter and 2.1% in the second.

The slow-down in real GDP in the first quarter reflected a decrease in personal consumption expenditures, private inventory investment and in state and local government spending. There were partly offset by an increase in exports and accelerations in both nonresidential and residential fixed investment.

However, despite this slowdown, all bets are not off for an interest rate hike in June.

“The trivial 0.7% annualized gain in first-quarter GDP, below the consensus forecast at 1.2%, won’t necessarily stop the Fed from hiking interest rates again in June,” Capital Economics Chief Economist Paul Ashworth said. “In recent years there is a well-established pattern of GDP growth disappointing in the first quarter and then rallying over the remaining three quarters.”

“Indeed, since 2010, the average for first-quarter growth is only 0.9%, compared with 2.4% in each of the other three quarters,” Ashworth said. “Fed officials are well aware of this potential residual seasonality.”

He pointed out that the slowdown reflects an increase of only 0.3% in consumption. However, consumer confidence is slipping lower, but still at historical highs, and could turn around quickly in the second quarter.