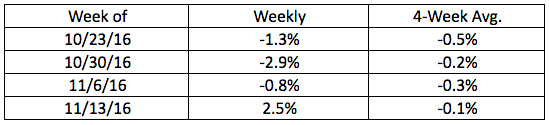

After weeks of consistent declines, appraisal volume finally posted an increase of 2.5% for the week of Nov. 13 from the prior week, according to the latest National Appraisal Volume Index from a la mode, which is provided exclusively to HousingWire.

It’s important to note that the previous week’s .8% decline included Veteran’s Day.

The uptick in volume help boost the four-week average, but it is still negative at -0.1%.

Check the chart below to see appraisal volume over the past four weeks.

Click to enlarge

(Source: a la mode)

As a reminder, appraisal volume is an indicator of market strength and holds some advantages over weekly mortgage applications.

For example, fallout is less for appraisals since they are ordered later in the mortgage process, after creditworthiness is determined, and there are few multiple-orders, by the time an appraisal is conducted.

While the latest mortgage applications report won’t come out until Wednesday morning, the prior Mortgage Bankers Association Weekly Mortgage Applications Survey for the week ending Nov. 11 recorded a significant drop in mortgage applications, falling 9.2% from one week earlier.

Mortgage rates are mostly projected to increase from here as the election quickly brought an end to weeks of lackluster mortgage application reports as the majority of mortgage product rates reached new highs.