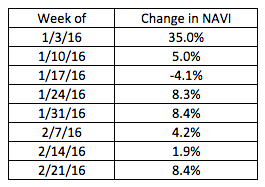

Appraisal volume jumped 8.4% for the week of Feb. 21, marking the fifth consecutive week of increases, as the spring homebuying season draws closer, a la mode, an appraisal forms software company that tracks appraisal volume throughout the country.

While the increase the previous week was minimal, it still ticked up 1.9% for the week of Feb. 14.

Kevin Golden, director of analytics with a la mode, added that except for the MLK holiday week, the index has moved upward in 2016.

Click to enlarge

(Source: a la mode)

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness determined and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.

However, Phil Huff, president and CEO of Platinum Data Solutions, added “We need to remember, though, that just because an appraisal is completed, doesn’t mean the mortgage transaction will close, particularly when it comes to refinances.”

“Spring buying season started earlier this year. That, and continued low rates are prompting homebuyers to get into the market,” Huff said.