While it may seem like the Consumer Financial Protection Bureau has been around forever, the CFPB actually opened its doors just four years ago – July 21, 2011.

In those four years, the CFPB has become synonymous with financial regulation, enacted serious and substantial changes across all areas of finance – and especially mortgage finance – and fined a number of companies for wrongdoing.

And whether you view the CFPB as a plague or a blessing on the financial services industry, the organization has undoubtedly altered the landscape.

The CFPB was born out of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which coincidentally is celebrating its fifth birthday today as well.

The CFPB was, in many ways, the brainchild of Elizabeth Warren. In Sep. 2010, the Obama administration appointed Warren to serve as the architect of the bureau.

Warren, who was then a Harvard Law professor and is now a U.S. Senator, was a top candidate to lead the CFPB, but the role of director eventually went to former Ohio Attorney General Richard Cordray.

Warren left the CFPB shortly after it officially opened for business on July 21, 2011.

When the CFPB opened, it was met with a great deal of controversy and controversy has surrounded the bureau ever since.

Just one day after opening its doors, the CFPB issued its first stopgap mortgage rule, issuing an amendment to the Alternative Mortgage Transaction Parity Act of 1982.

The amendment allowed state-licensed loan originators to make alternative mortgages under federal law, rather than state law.

In Nov. 2012, the CFPB partnered with the Federal Housing Finance Agency to begin collecting data for a “National Mortgage Database.”

"This partnership between FHFA and CFPB will create a unique resource that benefits the government and public as we seek to answer important questions about how the housing finance market is evolving and changing," FHFA Acting Director Edward DeMarco said at the time. "

But that was just the first of many changes to mortgage finance to be enacted by the CFPB.

The CFPB eventually launched national mortgage servicing rules, and changed the face of mortgage lending with the Ability-to-Repay rule and the Qualified Mortgage rule.

Cordray, for his part, has often been target of Congressional questioning, which, at times, has been less than cordial.

Corday has gone toe-to-toe with members of Congress repeatedly in his time as CFPB director.

In Sep. 2013, Representatives took turns firing off questions at Cordray, amid fears that the mortgage market would not be properly equipped to handle the implementation of the qualified mortgage rule and the qualified residential mortgage standard in 2014.

Earlier this month, Cordray was again in the crosshairs, this time by the Senate Banking Committee, which raised ongoing concerns about the bureau’s massive data collection, its management, its lack of oversight and its overspending.

But Congressional meddling didn’t stop the CFPB from taking action against many financial services companies for various offenses.

In Dec. 2013, Ocwen Financial Corp. (OCN) agreed to offer $2 billion in consumer relief and pay up to $127.3 million to settle CFPB investigation into its servicing practices.

Earlier in 2013, Castle & Cooke Mortgage received a consent order from the CFPB ordering the mortgage company to pay more than $9 million in restitution for consumers and $4 million in civil penalties for allegedly steering consumers into costlier mortgages.

But those weren’t the only companies to come under fire from the CFPB.

Earlier this year, the CFPB and the Maryland Attorney General took action against two of the top mega banks, Wells Fargo (WFC) and JPMorgan Chase (JPM), for an illegal marketing services kickback scheme they participated in with Genuine Title, a now-defunct title company.

As a result, Wells Fargo would be required to pay $24 million in civil penalties, JPMorgan would be required to pay $600,000 in civil penalties, along with $11.1 million in redress to consumers whose loans were involved in this scheme.

In April of this year, the CFPB and the Federal Trade Commission announced that the organizations are taking action against Green Tree Servicing, a subsidiary of Walter Investment Management Corp. (WAC), for “mistreating borrowers” who were attempting to save their homes from foreclosure.

As part of the agreement, Green Tree agreed to pay $48 million in restitution to victims, and a $15 million civil money penalty to the CFPB’s Civil Penalty Fund for its illegal actions, the CFPB said.

But those are just a few of the CFPB’s enforcement actions.

In fact, a search of “CFPB fine” on HousingWire returns 61 results.

In addition to being the enforcement agency that financial services’ companies now fear, the CFPB also is collecting information on borrowers, which has some concerned.

In Sept. 2014, HousingWire reviewed an open letter to the CFPB from George Mason University’s Mercatus Center about the CFPB’s open consumer-complaint narrative database, along with reviewing some other criticisms by HousingWire and outside critics.

The full text of the letter can be read here. Links to HousingWire stories on problems with the program in news articles and op-eds are here.

Despite those issues, the CFPB not only went ahead with its complaint database, it published 8,000 complaints against banks, lenders, and financial institutions in June.

The CFPB earned the ire of much of the mortgage industry with the protracted and convoluted implementation of the Know Before You Owe mortgage disclosure rule, also called the TILA-RESPA Integrated Disclosures rule.

The required loan documentation consists of two new forms: the Loan Estimate and the Closing Disclosure to ensure compliance.

These new forms consolidate the TILA-RESPA forms and are meant to give consumers more time to review the total costs of their mortgage. The Loan Estimate is due to consumers three days after they apply for a loan, and the Closing Disclosure is due to them three days before closing.

The CFPB has changed the effected date of the TRID rule twice, in just the last few months.

The original implementation date was supposed to be Aug. 1, bureau first announced a proposal to delay the effective date of TRID until Oct. 1 in order to correct an administrative error that it discovered in meeting the requirements under federal law, which would have delayed the effective date of the rule by two weeks.

And on July 21, the CFPB finalized the implementation date, officially shifting it from the previously announced Oct. 1 to Oct. 3.

The inner workings at the CFPB have also come into question by the House Financial Services Oversight and Investigations Subcommittee, which recently held a hearing at which CFPB employees testified about discrimination and retaliation at the regulatory bureau.

The charge is that the CFPB has an abysmal track record of ongoing discrimination, retaliation and fostering an insensitive, toxic workplace — and that it's getting worse.

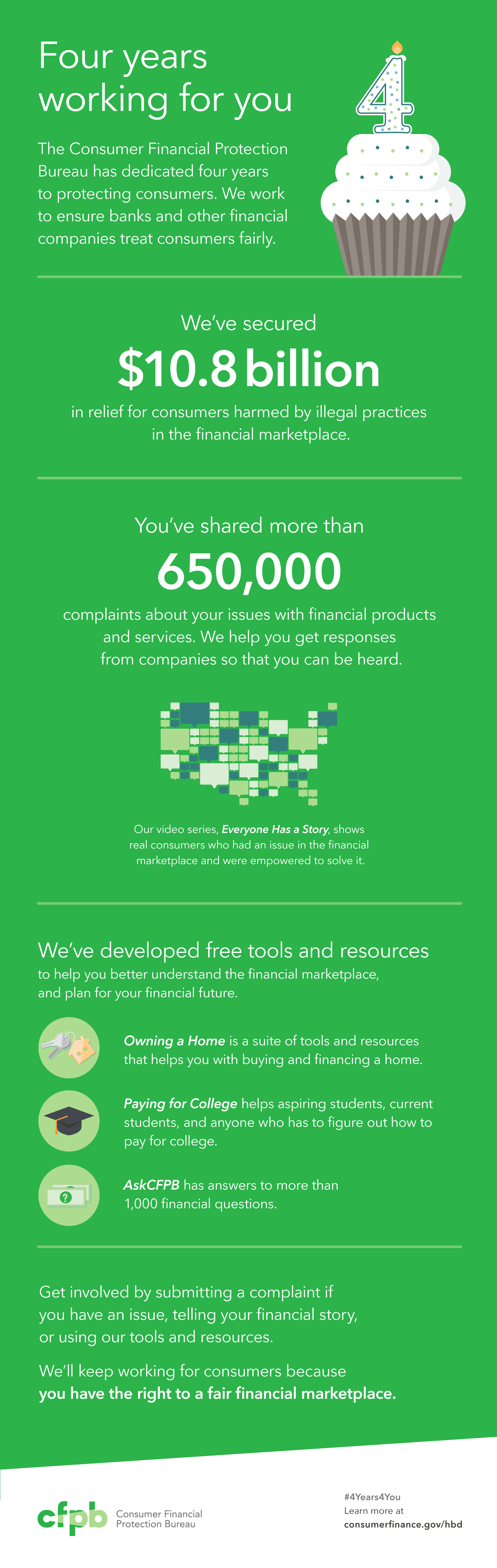

Despite all those alleged issues, the CFPB claims that it has secured $10.8 billion in consumer relief and received more than 650,000 complaints about financial products and services.

Click the image below to see more about the CFPB’s four years.

(Image courtesy of the CFPB)

It’s been an action-packed four years for the CFPB, and it’s a pretty safe bet that the next four will be more of the same.