While it is difficult to gauge the economy across the nation and in regional markets, these two charts from PulteGroup (PHM) and D.R. Horton (DHI) help to paint a decent picture.

However, keep in mind that the two homebuilders do not operate in every market.

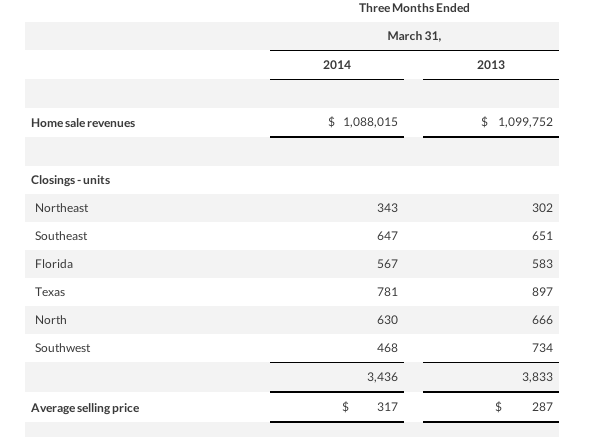

PulteGroup currently builds in 26 states and posted first-quarter net income Thursday morning of $75 million, or 19 cents per share.

Meanwhile, D.R. Horton operates in 27 states and posted first-quarter net income for its second fiscal quarter ended March 31, 2014 of $131 million, or 38 cents per diluted share.

So how does this disperse regionally?

According to Pulte’s earnings, most regions witnessed a drawback in regional home closings in the first quarter, with the southwest falling from 734 last quarter to 468. The only region to experience an uptick was the northeast, which grew from 302 to 343 closings. (click picture for bigger image)

For a second metric, D.R. Horton recorded an increase in home closings in the east (574 to 763), southeast 1,545 to 1,891) and south central (1,831 to 1,948). However, the company posted a drop in the southwest, falling to 305 from 381.