U.S. employers welcomed more than 200,000 employees to the jobs market in December, according to ADP Research Institute and Moody’s Analytics.

Private sector employment increased by 202,000 jobs, rising 29,000 in the goods-producing sector, which includes construction employment, according to the jobs report issued on Wednesday.

During the month, the housing market welcomed 37,000 more construction jobs, increasing significantly from the previous month’s decline.

Ahu Yildirmaz, vice president and co-head of the ADP Research Institute, said as 2019 came to a close, the U.S. saw expanded payrolls in December.

“The service providers posted the largest gain since April, driven mainly by professional and business services,” Yildirmaz said. “Job creation was strong across companies of all sizes, led predominantly by midsized companies.”

Despite this growth, Mark Zandi, Moody’s Analytics chief economist, warns the nation’s unemployment rate is likely to slow if employers don’t increase their hiring.

“Looking through the monthly vagaries of the data, job gains continue to moderate,” Zandi said. “Manufacturers, energy producers and small companies have been shedding jobs. Unemployment is low but will begin to rise if job growth slows much further.”

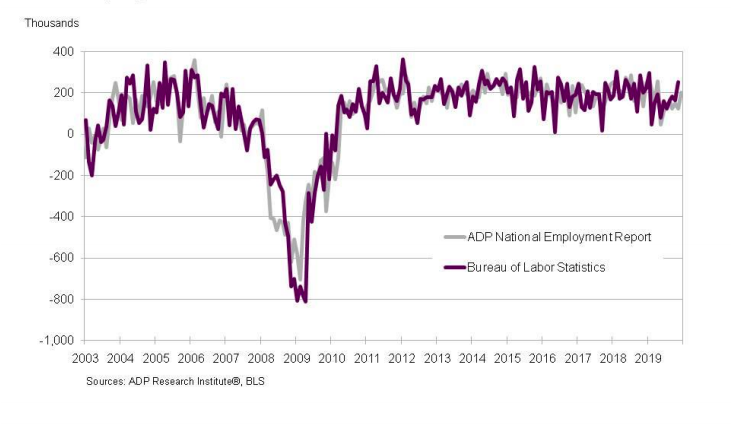

The chart below demonstrates the rate of increase since 2013:

The report reveals that the number of jobs added in November was revised up from 67,000 to 124,000.

Below is a breakdown of job segments that saw changes in employment between November and December:

The goods-producing sector increased by 29,000 jobs, including:

Natural resources and mining: Decreased 1,000 jobs

Construction: Increased 37,000 jobs

Manufacturing: Decreased 7,000 jobs

The service-providing sector increased by 173,000 jobs, including:

Trade/transportation/utilities: Increased 78,00 jobs

Information: Decreased 14,000 jobs

Financial activities: Increased 10,000 jobs

Professional and business services: Increased 61,000 jobs

Education and health services: Increased 49,000 jobs

Leisure and hospitality: Decreased 21,000 jobs

Other services: Increased 10,000 jobs

NOTE: This report is a monthly measure of the change in total U.S. non-farm private employment derived from actual, anonymous payroll data of client companies served by the company. The data is collected and processed with statistical methodologies similar to those used by the U.S. Bureau of Labor Statistics.