Despite the steady decline in forbearance volumes since the peak in April 2020, 2.7 million homeowners remain on forbearance plans – and more than 78% of them are now in an extension, according to the MBA Forbearance and Call Volume Survey.

Homeowners need information about what happens when forbearance plans end, and how they can achieve sustainable homeownership after a COVID-19-related delinquency. Ultimately, servicers are on the front lines to provide this information.

Fortunately, helpful resources and tools are available to servicers and other housing professionals that can bring clarity and resolution to support homeowners impacted by COVID-19.

#HelpStartsHere with your top tools for sustainable homeownership.

The Big Picture

The impact of COVID-19 led to circumstances that required new protocols and quick policy changes. To support lenders, servicers and homeowners, we published 46 Single-Family Seller/Servicer Guide Bulletins, over half were related to COVID-19 policies (as of November 2020).

From top to bottom, it was critical that servicers had a clear understanding of the policies, eligibility requirements and solutions to support COVID-19 impacted homeowners. Visit the COVID-19 Resource Center for recent policy changes, job aids and live training.

Homeowner Education

The doorway to homeowners is through housing professionals. We rallied them to educate the influx of homeowners seeking information on mortgage relief.

Approximately 75% of housing counseling organizations heard from homeowners that they are either delinquent or about to become delinquent and desire to understand their options to remain in their homes.

Half of those that are reaching out for housing counseling are not aware of forbearance programs that exist today, revealed Marietta Rodriguez, NeighborWorks America President and CEO, during the discussion at the State of the Nation’s Housing 2020.

Our Interactive Guide helps homeowners make proactive and informed decisions about the short and long-term impacts to their finances. Share key materials – like those that are available on My Home website – that lay the foundation for understanding the CARES Act, mortgage relief and steps to take to remain in their homes.

Forbearance

As one of the most common mortgage relief options, forbearance provides a way to suspend mortgage payments until the end of the forbearance period. As the pandemic erupted, servicers needed to be able to differentiate fact from fiction and openly discuss forbearance (and post-forbearance) options with homeowners.

This is more important than ever, as over 78% of 2.7 million homeowners are now in a forbearance period extension.

Using a provided call script servicers can confidently communicate to homeowners about forbearance including COVID-19 related flexibilities. Most homeowners will likely enter into a payment deferral after a forbearance plan ends. Understand the value and impact of this option by listening to the perspective of Mike Zarro of Truist during this Home Starts Here podcast.

Post-forbearance

Communicating with homeowners and assessing their options is a big hurdle to the next milestone of sustainable homeownership. Servicers have been on the front lines to seamlessly transition homeowners from forbearance plans to the next appropriate option based on their unique circumstances, while housing counselors have had to confidently advise them on steps to take for resolution. (Read more in our recent article, The Three Cs of Post Forbearance).

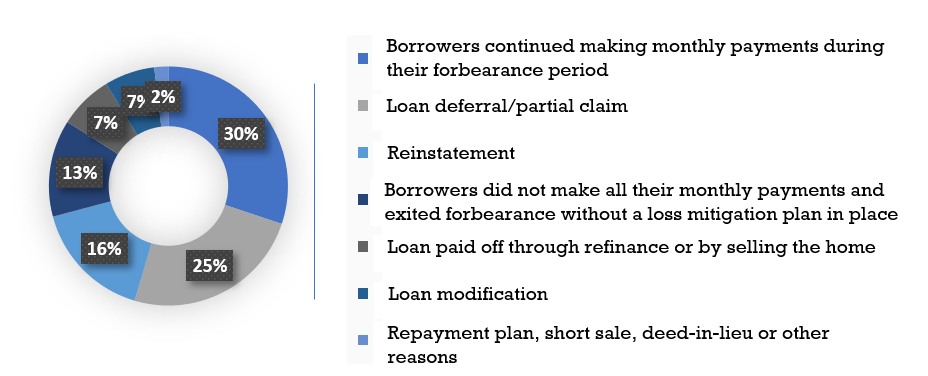

As of December 14, 2020, the MBA Survey indicates that homeowners who exited forbearance plans between June 1 and December 6, 2020 fall into the following categories1:

Kick start your assessment of loss mitigation options and connect to resources and training webinars to better manage delinquencies. Step through this easy guided experience to get a sense of homeowner options based on their hardship type.

Freddie Mac is committed to #HelpStartsHere, providing you with trusted and effective solutions during an evolving market.