When I came up with the “savagely unhealthy housing market” label in February of this year, it was based on the premise that the housing inflation story that we have had to deal with since 2020 was a historical event. It facilitated a very unhealthy housing market in 2020-2021 that became savage in 2022. The biggest cause was a lack of choices for American homebuyers.

Inventory, which has been falling for years, broke to all-time lows in 2020. We didn’t have a seasonal push in inventory in 2020, and things worsened in 2021. To top it all off, we started 2022 at all-time lows, forcing bidding action everywhere until mortgage rates rose. And we aren’t talking about your grandfather’s mortgage rates rising; we went from 2.5% to over 7% in a very short period of time.

Of course, this has brought back some inventory, as demand weakness always creates inventory through accumulation. However, as we can see below, we are not back to the historical norms of 2-2.5 million active listings, but at just 1.28 million today.

This doesn’t mean homebuyers don’t have something of an edge now: As inventory has increased and buying power has faded, the buyers who are available are dealing with a lot less competition as the bidding wars are ending.

From NAR:

One of the essential variables I added to my work during 2020-2024 was to put an effective price-growth model for this period to know when the housing market would get into price inflation trouble. My model was 23% total cumulative price growth from 2020-2024 — if we only grew at 23% for five years, we would be ok with where wage growth was going.

Well, that got destroyed in only two years.

In the summer of 2020, I talked about what could change the housing market and it was based on the premise that the 10-year yield needed to get above 1.94%, which would mean mortgage rates would climb above 4%. It wasn’t part of my forecast in 2020 or 2021. However, for 2022, part of the forecast was that if global bond yields rose, especially in Germany and Japan, we could break the 1.94%.

Of course, a lot more drama happened after March of this year and the 10-year yield got to 4%, something I wasn’t looking for. However, with price growth and mortgage rates skyrocketing, the hit to affordability is historic.

Affordability matters, regardless of inventory data, and it isn’t a healthy aspect when even the monthly supply of inventory is below four months. I talk about four months of supply a lot because I believe a balanced marketplace is four months, not six months. It’s very rare to get six months of supply in America for the existing home sales marketplace since 1996.

The only time this happened was 2006-2011 — the housing bust years. That had a lot of forced selling into a weaker demand period as credit got tighter in relationship to the demand curve. This means the housing boom period of 2002-2005 had major credit tightening, which won’t happen this time around when the next recession hits.

Currently, we are at 3.2 months supply, which historically isn’t a lot, but that’s up from the recent lows and we are dealing with major affordability issues.

I talk about 2019 inventory levels a lot because in 2019 real home prices briefly went negative, showing that you don’t need to have six months plus of inventory to have pricing cool down. In fact, at a 2019 conference, I was so happy about this that I labeled the chart below as Great News! Not sure if the audience agreed with my take.

Mortgage rates went up to 5% in 2018, cooling down the housing market but nothing too dramatic for the existing home sales market. Purchase application data was only negative three weeks out of the year. Home prices ebb and flow, pricing was working in the sense that sellers met homebuyers to a degree.

Now fast forward to 2022. We’ve seen a massive price and payment inflation event with pricing still rising and the biggest mortgage rate increase in a single year in recent modern-day history. Unlike 2018-2019 when purchase application data didn’t budge much, we have had a trend of well over 20% year-over-year declines on the four-week moving average on this index.

In the last three months of the year we can expect some weeks to show year-over-year negative prints of 35%-45% as comps are getting harder. This is a real hit to demand.

In 2018-2019 the affordability metrics weren’t as bad as people thought. This isn’t the case anymore. This is why I was so vocal about price escalation starting toward the end of 2020 and into this year. Even my 2022 price forecast shows a big deceleration of price growth from 20% to as low as 5.2%. My forecast was too low as total inventory data early in the year was too low and rates didn’t move higher until April.

Now with mortgage rates above 7% and pricing not being negative this year, homebuyers — at least those who can afford to buy a home — have an advantage in certain markets where inventory is at 2019 levels because the supply of homes of 2019 to me is a functional marketplace. This is how you should look at housing now.

When mortgage rates were below 4%, the market pricing power was too strong with inventory at all-time lows. This isn’t the case anymore. Even though total inventory is near all-time lows and we are going to start 2023 with historically low inventory, it doesn’t mean that pricing doesn’t matter.

From Altos Research:

So my big takeaway from the savagely unhealthy housing market of 2022 is that 4%-5% mortgage rates didn’t do the damage I thought they would and I believe this is why my price growth forecast of 5.2%-6.7% for 2022 is going to be wrong and too low.

However, 5%-6% mortgage rates did change the marketplace and now 6%-7% mortgage rates are changing behavior so that we see new listing data declining even more as sellers are calling it quits on their plan to list. Homebuyers who can qualify for a house now are in a much better spot than the previous few years, but hey, you have to deal with a massive hit to the total payment of your home. For some homebuyers, it’s not a big deal, but for others, it stings.

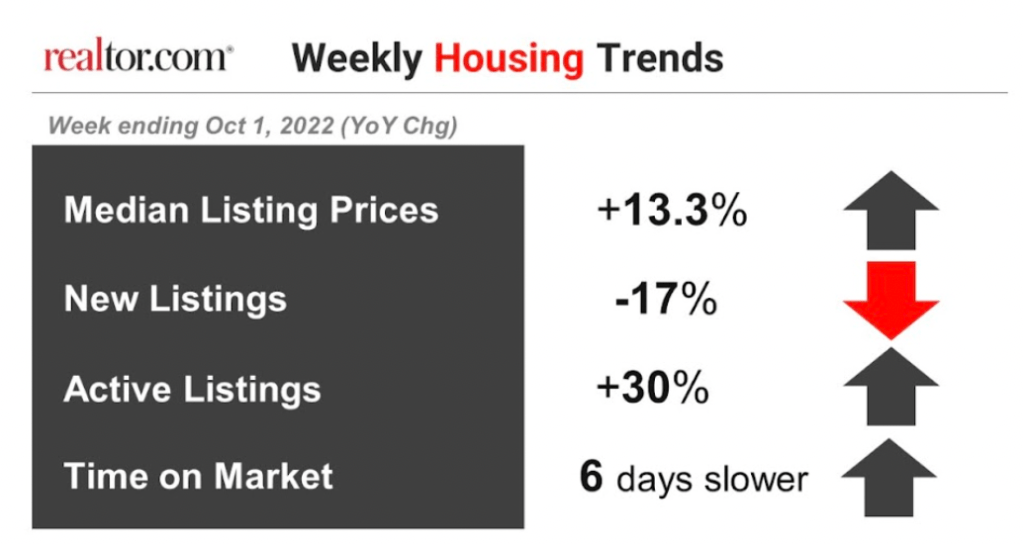

From Realtor.com:

Homes that are priced right, especially in areas below 2019 inventory levels, are selling quickly, and those homes that aren’t priced right to the marketplace are taking longer to sell. Sixteen days to sell is still too low for my taste; this reflects how most of the country isn’t back to 2019 levels.

In a few weeks, inventory will start to be affected by seasonality; the question is, will those homes that are taking longer to sell call it quits for the year? Inventory traditionally falls in the fall in winter and rises in the spring and summer. However, with weakness in demand, inventory can accumulate.

The last time total inventory grew was in 2014 because we had weak demand. Purchase application data was down on average 20% year over year, and adjusting to the population was the lowest level in the index ever. In 2014 we still had the seasonal dive in inventory in the fall and winter, so time will tell if that will be the case again with the increase in inventory this year.

My premise earlier in the year of total inventory data getting back to 2019 levels in 2023 is hitting a snag with the decrease in new listings, so that is something we don’t want to see for the spring of 2023. To have a balanced housing market, we need active listings to rise yearly, which they typically do; 2020 was an anomaly. We shall see what the next few months bring for housing; however, as we close the books for 2022, we can agree it was a savagely unhealthy housing market.

What we don’t want to be in 2023 is stuck with low total inventory — sellers not wanting to sell, homebuyers and sellers fighting over price, and sellers being stubborn about it. With more inventory, sellers have to be less stingy; this is why I am a fan of getting total inventory data back to 2019 levels.

Good info thanks. You’ve mentioned a few times that you don’t anticipate the tightening of credit to be an issue in the next recession. Do you have any thoughts on what the next recession would look like in terms of housing? Obviously high interest rates seem likely to be a factor, but any other important themes to consider?

For housing, the biggest issue for the next recession would be the impact on renter households that have less than a high school education because that sector of the labor market tends to have the highest unemployment during a recession and the least amount of financial assets and income levels.

Homeowners, on paper, have had the best financial profiles I have ever seen; they will weather the storm better than single-household income renters. However, with every economic expansion/recession. Late-cycle lending is always a risk for a future foreclosure, and that shouldn’t change when the next downturn hit

Good to know thanks again