A new report shows that seniors are sitting on more housing equity than they ever have before.

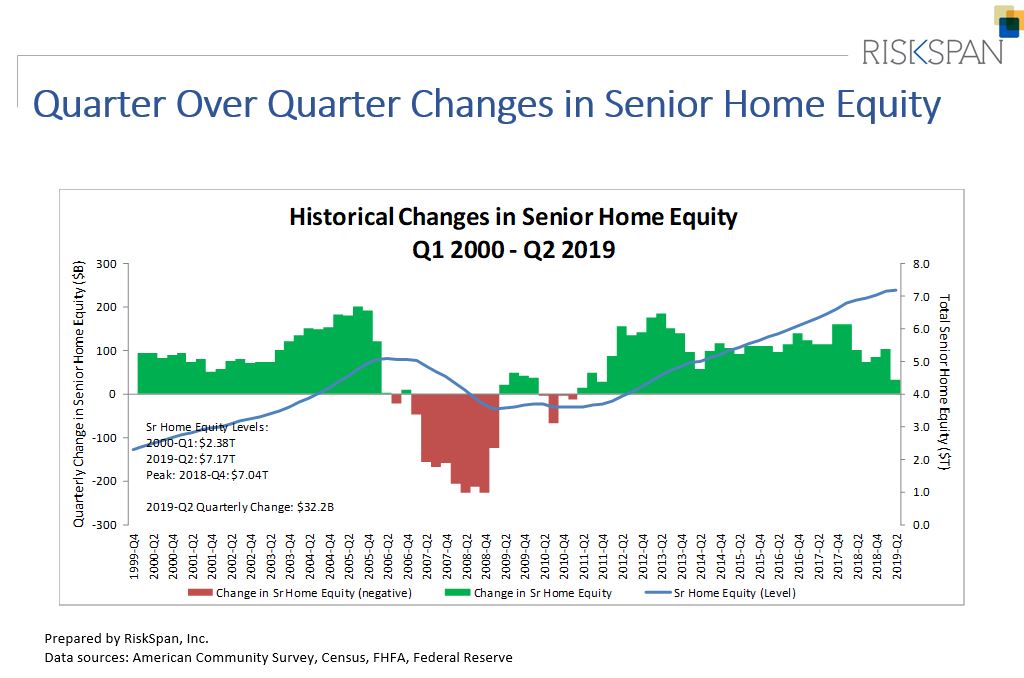

According to the National Reverse Mortgage Lenders Association, overall senior housing wealth hit an all-time record in the second quarter, $7.17 trillion.

Homeowners 62 and older also saw their housing wealth increase by 0.5% percent or $32 billion in the second quarter.

The data comes courtesy of the NRMLA/RiskSpan Reverse Mortgage Market Index, which was first released in 2000. According to the report, the RMMI also hit a record high in the second quarter, climbing to 258.44.

The report stated that the increase in senior homeownership wealth was caused by an approximately 0.5%, or $47 billion, increase in senior home values, which was offset by a 0.9%, or $14.6 billion, increase of senior-held mortgage debt.

“Many retired and soon-to be-retired Americans lack the financial assets for a comfortable retirement, yet the most commonly held and valuable asset for most of them is their home,” said NRMLA’s Executive Vice President Steve Irwin. “Responsible use of home equity may be the best option that ensures they have food, medicine and other basics for a comfortable retirement.”