Monday Morning Cup of Coffee takes a look at news across HousingWire's weekend desk, with more coverage to come on bigger issues.

One month ago, HousingWire chronicled the downfall of Butler & Hosch, once one of the nation’s largest mortgage industry law firms.

Butler & Hosch shut down abruptly last month after almost 35 years in business, filing for an for Assignment for the Benefit of Creditors to Florida law firm Michael E. Moecker & Associates, which is an action similar to Chapter 7 bankruptcy.

Bob Hosch, CEO and senior partner at Butler & Hosch sent a memo to all the firm’s vendors, clients and employees on May 14, saying that the firm no longer had enough cash to continue operating or even to fund payroll for the week, rendering the firm’s 700 employees unemployed seemingly overnight.

“Though Mr. Moecker has complete access to our assets, he will not have sufficient cash on hand to fund payroll at the end of this week,” Hosch said in the memo, which was obtained by HousingWire.

“Without BH employees and attorneys there is no ongoing operation. BH cannot continue to function,” Hosch continued. “To be clear, while I continue to hold out hope that our existing lender and/or strategic partners may provide an infusion of cash today, without it, BH will have no choice but to close its doors immediately."

Now, one month later, some parts of the firm – from the computers, to the file cabinets, to some clients and even some employees – are on the verge of a reprieve.

According to a report from the Orlando Sentinel, Pennsylvania foreclosure law firm Stern & Eisenberg is bidding $150,000 for file cabinets, furniture, computers and servers from six Butler & Hosch offices.

From the Orlando Sentinel report:

Eisenberg’s managing partner, Steven Eisenberg, said in an interview he is trying to pick up some of the foreclosure cases.

“I’m in the process of acquiring the case management system, which does have some data. I don’t take control of the files but some of the clients are retaining me,” Eisenberg said. “I hope that my firm picks up the cases, and that clients use my services.”

The report states that the computers will be scrubbed of client information, per the request of the attorney represent Moecker’s office, Donald Kirk.

Kirk told the Orland Sentinel that roughly half of Butler & Hosch’s foreclosure case files have already been transferred back to the lender.

“We’ve already transitioned 20,000 case files out to their clients, about 10,000 of which went to Bank of America’s representative,” Kirk told the Orlando Sentinel. “We have worked diligently in trying to preserve the client files by getting them to the clients as quickly as possible. It’s been a challenge because we have very limited assets to work with, and we can’t look at the files because of confidentiality issues.”

Eisenberg also told the Sentinel that he has hired 60 to 70 of Butler & Hosch’s former employees.

According to the Sentinel report, a hearing to approve the sale to Eisenberg is scheduled for July 6 in Orlando.

Last week saw interest rates climb back above 4% for the first time since Nov. 2014. According to Freddie Mac’s Primary Mortgage Market Survey, the 30-year fixed-rate mortgage averaged 4.04% with an average 0.6 point for the week ending June 11, up from last week when it averaged 3.87%.

Somewhat surprisingly, mortgage applications actually rose during a similar time period, despite the rise in interest rates. Mortgage applications increased 8.4% from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending June 5, 2015.

Those two developments could mean that the housing recovery is actually on stronger footing than previously thought, according to analysts at Bank of America Merrill Lynch (BAC).

In BofAML’s Securitization Weekly Overview, MBS strategists Chris Flanagan and Mao Ding write that last week’s reports are a “moment of truth” for the housing industry.

“The week saw a sharp move higher in the MBA purchase applications index. We have long viewed this index as an important barometer of the ability of housing demand to reach escape velocity and be able to absorb higher interest rates,” the analysts write.

“Against the recent backdrop of sharply higher interest rates, this week’s MBA index strength is an encouraging sign for the housing bulls,” they continue. “We remain a little more cautious, however, as we think it is too early to say definitively. Nonetheless, we acknowledge the strength and think it has significant implications for interest rates and securitized products going forward.”

Flanagan and Ding go on to say that if the strength in the purchase index is consistent in the coming weeks, it likely means that the U.S. economy is stronger on a broader basis. But the analysts note that a continually stronger economy increases the likelihood that the Federal Reserve will proceed with a September tightening.

“We think this means that interest rate volatility will also continue to move higher,” Flanagan and Ding write. “We see the scenario of higher interest rates, mortgage rates, and interest rate volatility as a negative for securitized products, even after the recent backup in rates and securitized products spreads.”

One segment of the population that isn’t buying right now, no matter the interest rates, is the Millennial.

HousingWire has chronicled the “Millennial issue” (quotation marks meant ironically) for years. Recently, our very own Brena Swanson (a Millennial herself) moderated a panel held by the Housing Policy Council at the Financial Services Roundtable with housing’s top economists discussing, what else, Millennials and how to attract them to the market.

One of the main takeaways from the Swanson-moderated panel is that Millennials want to buy, despite the traditional “they’re all content to live at home with their parents forever” rhetoric.

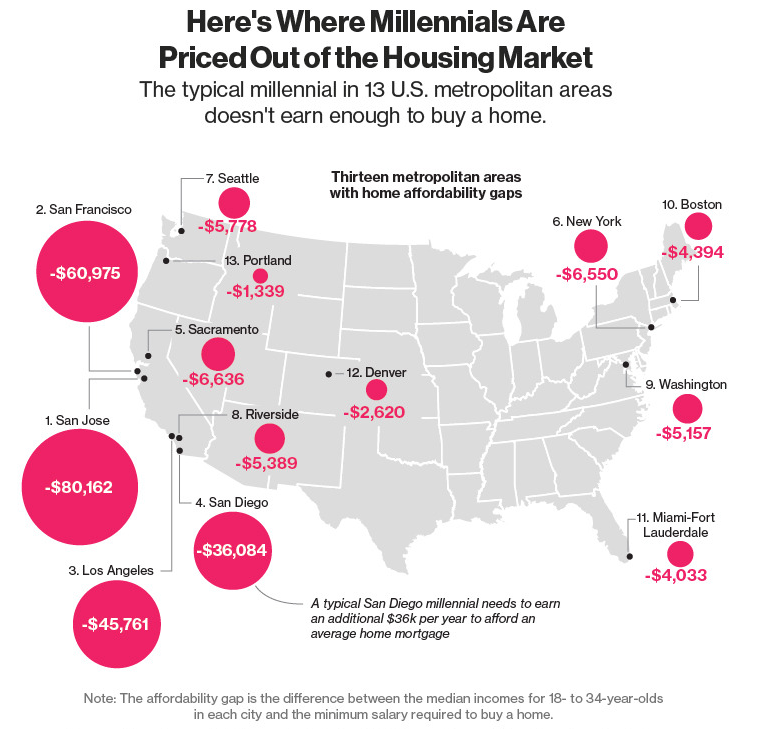

Over at Bloomberg, there’s a report that shows that in some of the nation’s largest cities, Millennials can’t buy even if they want to, because the cost of a home is well beyond their means.

From the Bloomberg report:

Bloomberg used data from the U.S. Census Bureau, Zillow Group Inc. and Bankrate.com to quantify how much more money millennials would need to earn each year to afford a home in the largest U.S. cities. The good news is that out of 50 metropolitan areas, 37 are actually affordable for the typical 18-34 year-old.

The bad news is that the areas that often most appeal to young adults are also the ones where homeownership is the most out of reach.

According to Bloomberg report, there are 13 metropolitan areas where the average Millennial doesn’t earn enough to afford the area’s average home.

Perhaps unsurprisingly, the top five metro areas that boast the largest affordability gap for Millennials are in California, including San Jose, San Francisco and Los Angeles.

Click on the graphic below to see the 13 areas where Millennials can’t afford a home, according to Bloomberg.

(Image courtesy of Bloomberg)

One issue with the Bloomberg report (which they do disclose) is the assumption that the average Millennial has already saved up a down payment of 20%.

From the Bloomberg report:

Bloomberg's calculations assume that millennials have already saved up the 20 percent they'd need for a down payment, which is a problem in itself. Families where the head of household was under 35 years old had a median net worth of $10,400 in 2013, according to the Federal Reserve's Survey of Consumer Finances.

On the other hand, for those of us in the know, we are all well aware that you don’t need 20% down to afford a home anymore. Far from it, in fact, thanks to the 3% down programs offered by both Fannie Mae and Freddie Mac.

So maybe it’s not an affordability problem, but rather an education problem, whereas potential borrowers (like Millennials, for example) aren’t aware they may only need 3% down.

Something to think about.

No banks were closed for theweek ending June 12, according to the FDIC.