Thanks to the continued impact of COVID-19 on the economy, approximately 10% of borrowers whose mortgages are backed by the Federal Housing Administration or the Department of Veterans Affairs are in forbearance.

The data comes courtesy of a new report from the Mortgage Bankers Association, which polled more than 50 mortgage servicers that collect payments on nearly 77% of the mortgage market.

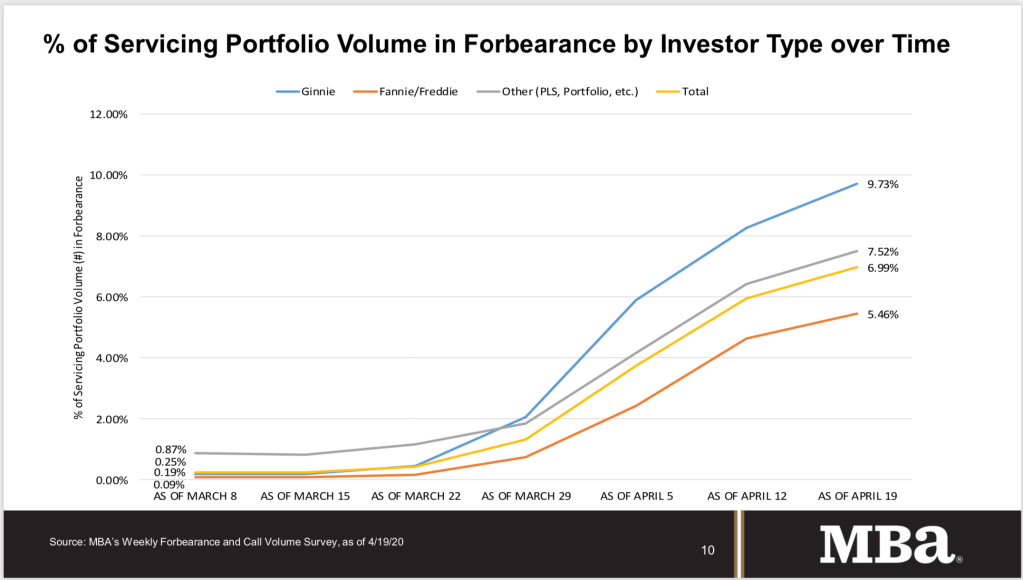

According to those servicers, nearly 7% of the 38.3 million loans they service were in forbearance as of April 19, 2020.

That’s an increase of more than one full percentage point from the previous week’s total of 5.95%.

But the largest segment of borrowers in forbearance have mortgages backed by the FHA or VA. According to the report, 9.73% of the loans in Ginnie Mae’s portfolio are in forbearance. That’s an increase of 1.47% from the previous week’s total of 8.26%.

Ginnie Mae is the government agency that issues mortgage bonds backed by FHA and VA loans.

According to the MBA report, the share of Fannie Mae and Freddie Mac loans in forbearance also increased, rising from 4.64% to 5.46%. The share of other loans (those included in private-label securities or held in portfolio) in forbearance rose from 6.43% to 7.52%.

It should be noted that this data is from the week ending April 19. Newer data from Black Knight shows that the share of GSE loans in forbearance is at 5.6%.

But the Black Knight data, which is pulled from a sample set of loans that represent the majority of the mortgage market and extrapolated across the entire mortgage landscape, shows that 8.9% of FHA/VA borrowers are in forbearance and about 5.7% of loans held either in portfolio or privately securitized are in forbearance.

Neither report is fully inclusive and representative of the entire mortgage market, but both sources of data show that there are still many borrowers who need forbearance.

“Forbearance requests fell relative to the prior week but remain roughly 100 times greater than the early March baseline,” said Mike Fratantoni, MBA’s senior vice president and chief economist. “While the pace of job losses have slowed from the astronomical heights of just a few weeks ago, millions of people continue to file for unemployment. We expect forbearance requests will pick up again as we approach May payment due dates.”

But Fratantoni said that there are some signs that forbearance requests could begin to decline.

“The combination of stimulus payments, expanded unemployment insurance benefits, further fiscal and monetary actions, and states reopening will hopefully begin to stabilize forbearance requests and the overall economy,” Fratantoni said.