Despite construction spending being on the uptick in recent months, the number of unfilled construction jobs rose in September on a year-over-year basis as labor shortages continue to impact the construction business.

According to the Bureau of Labor Statistics Job Openings and Labor Turnover Survey, the estimated number of job openings declined from August’s total to 338,000 in September. In April, it reached a post-recession high of 434,000.

The September 2019 count of unfilled jobs represents a year-over-year gain compared to the 299,000 estimated unfilled construction jobs in September 2018.

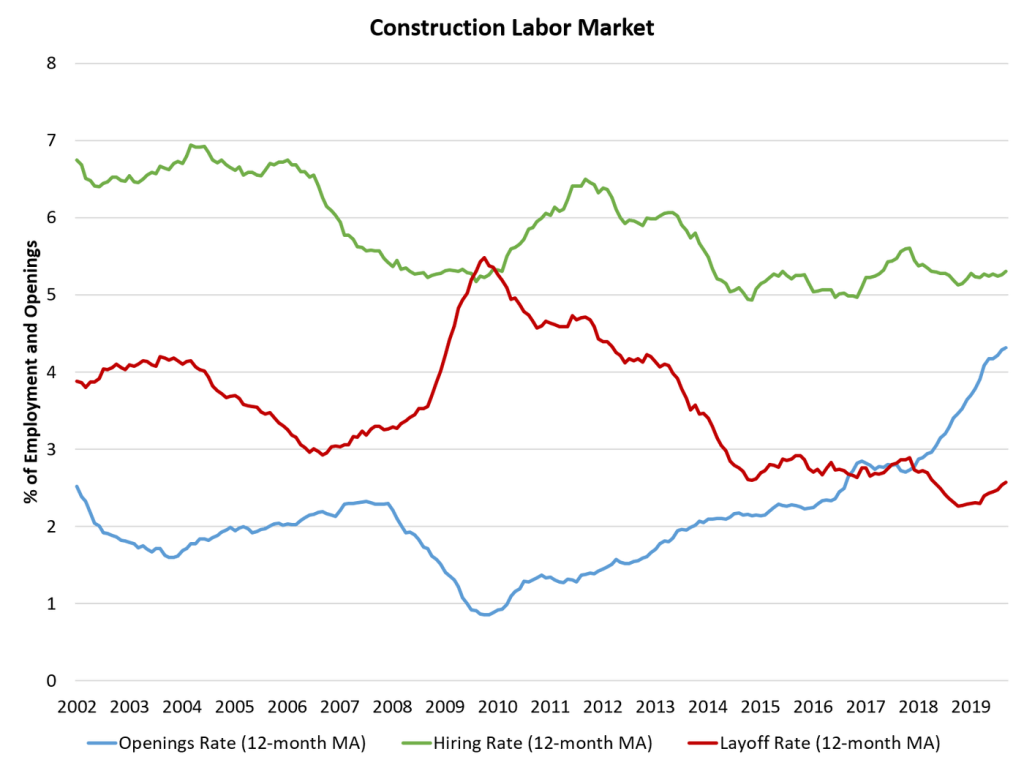

Basically, the open position rate sank to 4.3%, after reaching its cycle high in April of 5.5%. The peak rate during the building boom just before the recession was below 2.7%, the National Association of Home Builders said.

Overall, the trend for open construction jobs has been increasing since the end of the Great Recession, NAHB said. This has challenged builders, as construction has lagged.

New home sales fell 0.7% in September, according to the Census Bureau and the Department of Housing and Urban Development.

NAHB said that the construction hiring rate held steady at 5.3% in September, and layoffs rose to 2.6%, linked to housing affordability.

Construction spending this summer was 1.9% lower than it was in August 2018, the Census Bureau said.

Spending on private construction was at a seasonally adjusted annual rate of $955 billion, nearly the same as the revised July estimate of $954.8 billion, and 4% below in 2018.

Of that, residential construction spending was at a seasonally adjusted annual rate of $507.2 billion in August, which is 0.9% above the revised July estimate of $502.5 billion but 5% down from a year ago.

The ratio between new single-family homes and multi-story homes is also shrinking, with more builders starting one-story, single-family homes.

The share of new homes with two or more stories fell from 55% in 2017 to 53% in 2018, while the share of new homes with one story grew from 45% to 47%, NAHB said last month.