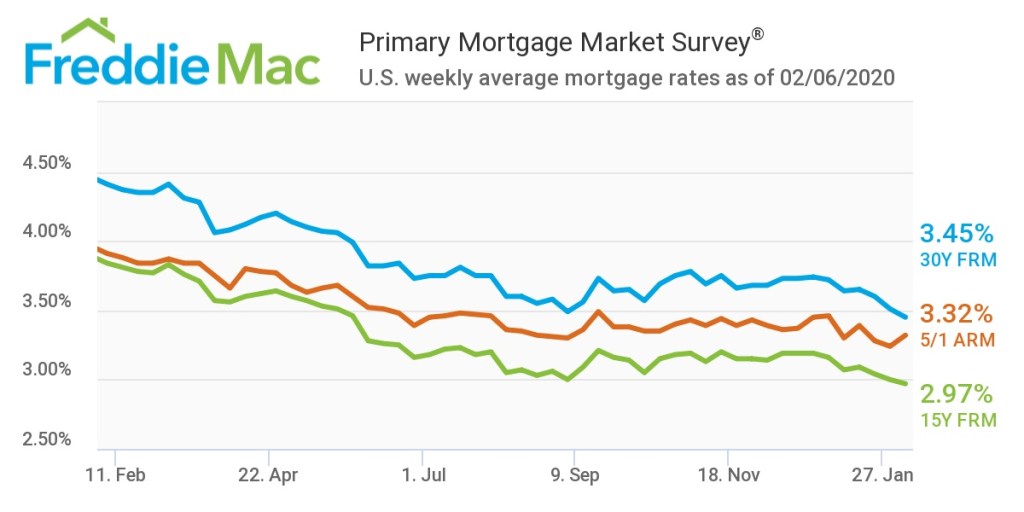

The average U.S. rate for a 30-year fixed mortgage this week fell to a three-year low of 3.45% as worries about coronavirus drove investors into the U.S. bond markets.

That’s the lowest rate since 3.42% in the first week of October 2016 and it’s almost a full percentage point below the 4.41% recorded a year earlier, according to the Freddie Mac report.

Investors are piling into U.S. bonds as a safe haven while the world weighs the possible economic implications of the coronavirus pandemic that has infected more than 20,000 people, primarily in China. The increase in competition for bonds, including mortgage-backed securities, squeezes yields and drives mortgage rates lower.

“As rates fell for the third consecutive week, markets staged a rebound with increases in manufacturing and service sector activity,” said Sam Khater, Freddie Mac’s chief economist. “The combination of very low mortgage rates, a strong economy and more positive financial market sentiment all point to home purchase demand continuing to rise over the next few months.”

The 15-year FRM averaged 2.97% this week, also a three-year low, Freddie Mac said. This time last year, the 15-year FRM was 3.84%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.32% this week, rising from last week’s rate of 3.24%. This rate is still much lower than a year ago when it averaged 3.91%.

The image below highlights this week’s changes: