Home prices climbed by 4.9% in the third quarter from a year earlier, marking the 33rd consecutive quarter of increases, the Federal Housing Finance Agency said in a report.

Nationally, home prices in all 50 states and Washington, D.C. increased since the third quarter of last year.

“House prices have risen every quarter for the last eight years,” said William Doerner, FHFA supervisory economist. “Relative to a year ago, market indices are still trending upward for the nation as a whole as well as in every census division, state, and the top 100 metro areas. Price gains, though, are continuing to slow their upward pace in a few cities with large housing markets.”

The states with the largest gains were Idaho at 11.6%, Maine at 7.9%, Arizona at 7.9%, Utah at 7.8% and Indiana at 7.4%.

The states that showed the least amount of annual appreciation are Illinois at 1.9%, Connecticut at 2.2%, Maryland at 2.4%, South Dakota at 2.7% and Iowa at 3.2%.

According to FHFA, home prices rose in all of the 100 largest metropolitan areas in the U.S. over the last four quarters.

Annual price increases were the largest in Boise City Idaho, where prices climbed by 11.1%, whereas prices were the weakest in Camden, New Jersey where they only increased by 0.7%.

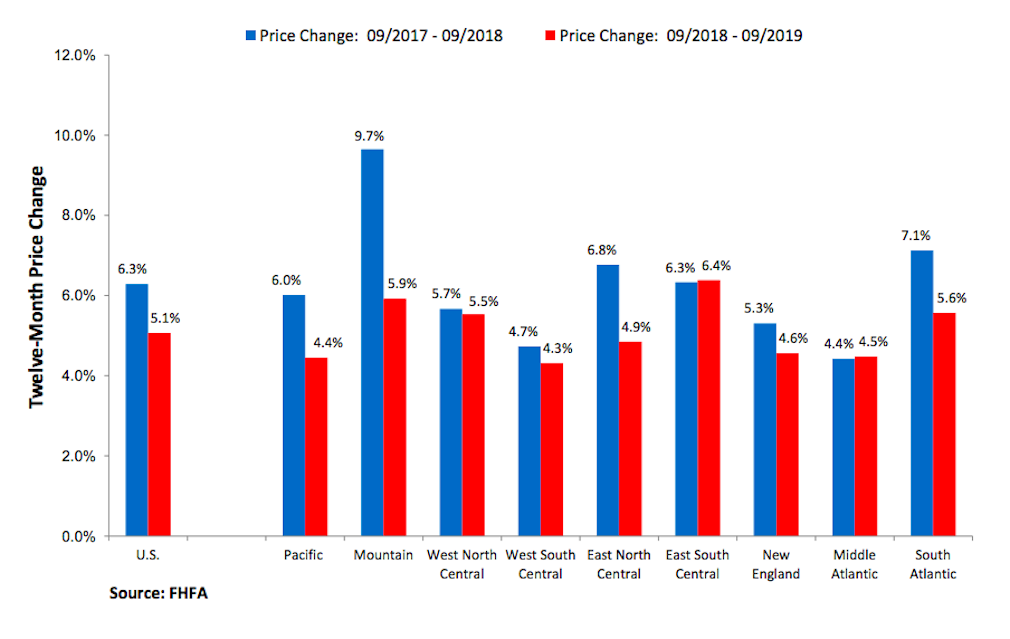

Across the nine census divisions, the Mountain division once again saw the strongest appreciation growth, rising 6.9% annually and increasing by 1.8% in the third quarter of 2019.

Annual house price appreciation was the weakest in the Middle Atlantic division, where house prices rose by only 4% year over year.

The chart below compares 12-month price changes to the prior year: