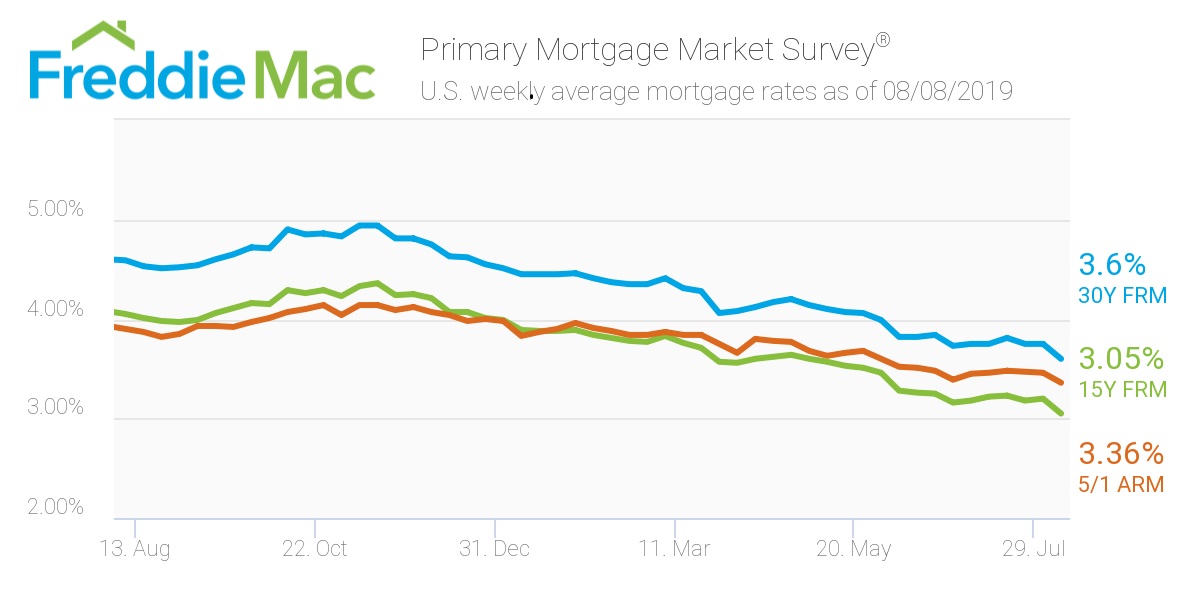

This week, the 30-year, fixed-rate mortgage returned to a 3-year low, averaging 3.6%. The rate sits below last week’s average of 3.75% and is also a significant decline from its 2018 rate of 4.59%, according to the Freddie Mac Primary Mortgage Market Survey.

“There is a tug of war in the financial markets between weaker business sentiment and consumer sentiment,” Freddie Mac Chief Economist Sam Khater said. “Business sentiment is declining on negative trade and manufacturing headlines, but consumer sentiment remains buoyed by a strong labor market and low rates that will continue to drive home sales into the fall.”

The 15-year FRM averaged 3.05% this week, falling from last week’s 3.2%. This time last year, the 15-year FRM came in at 4.05%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.36%, retreating from last week’s rate of 3.46%. This rate is much lower than the same week in 2018 when it averaged 3.9%.

The image below highlights this week's changes: