It keeps getting more expensive to live in the U.S., as new data shows that both rent and home prices are continuing to climb.

Rent values in the U.S. have continued to rise over the last nine months, according to new analysis from Zillow.

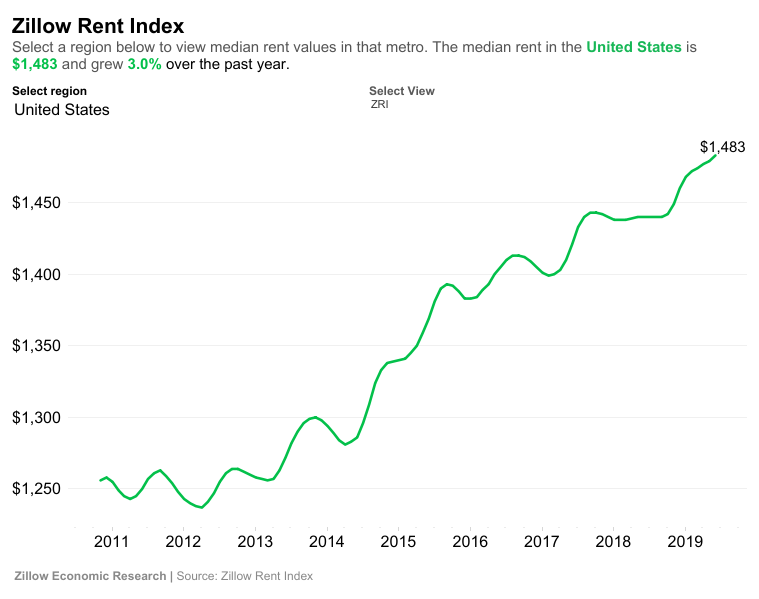

Zillow's new report states that the median rent value in the U.S. increased 3% in June on an annual basis, up to $1,483. A surge in new apartment supply over the past few years that halted rent growth for much of 2018 has slowed down, with rent growth re-accelerating throughout the first half of 2019.

Zillow says the typical U.S. home is worth $227,700, up a little more from May after month-over-month values dropped for the first time in seven years this spring.

According to the Zillow report, there were 12,128 fewer homes for sale in June 2019 than there were in June 2018. This may be a sign that housing markets are beginning to stabilize as opposed to facing a downfall.

"After years of declines, inventory appears to have largely hit bottom, but not yet begun to rebound in earnest," Zillow said in its report. "Instead of moving decisively in one direction or another, over the past 8-12 months inventory has been bouncing up and down by small amounts."

Annually, home values grew 5.2%, down from 7.6% a year earlier.

"As much as record numbers of new apartments led many to believe that rental markets might have become oversaturated with new supply, the reality is that demographics and general economic health continue to keep the pressure on," said Zillow Director of Economic Research Skylar Olsen.

Rents are up year-over-year in 49 of the nation's top 50 markets with Milwaukee as the only exception.

(Click to enlarge. Image courtesy of Zillow.)

"Yes, we saw rents fall in 2018, but that was driven by the concentration of supply in urban areas and large buildings at higher end price points competing against each other,” Olsen said. “What the rental market still craves are affordable units spread across the landscape. Show me a three-bedroom apartment in a small building located near good schools and I'll show you an older millennial with kids ready to move in."