It seems homeowners are finally coming to terms with the fact that their properties aren’t appreciating like they used to.

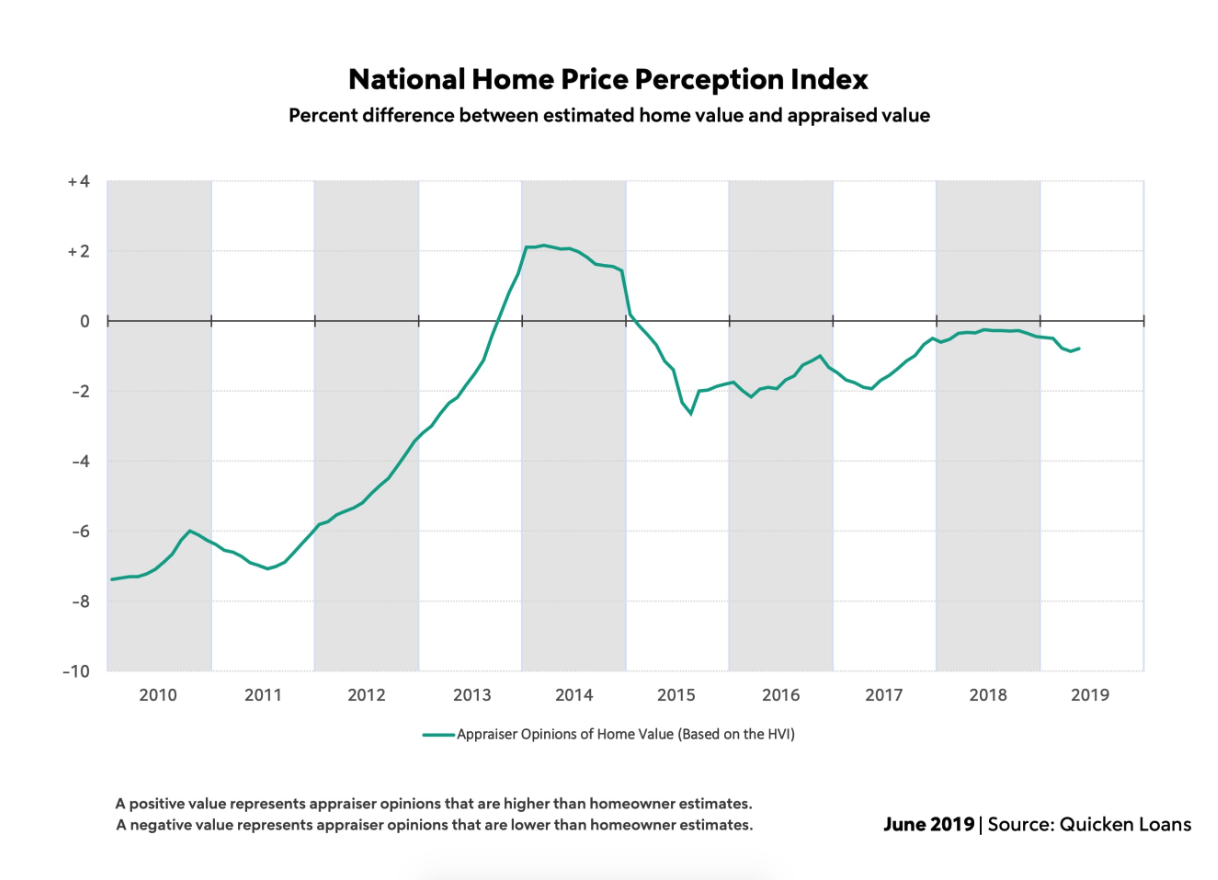

The difference between an appraiser’s value estimate and a homeowner’s expectations has narrowed as owners come to accept a slower rate of home-price growth, according to the latest Quicken Loans Home Price Perceptions Index.

In May, the average home appraisal was 0.79% lower than the homeowner’s estimate, reflecting a narrowing gap after six months of widening.

According to the report, none of the cities evaluated had an appraised value that was 2% lower than what owners expected.

Philadelphia had the largest gap, with the average appraisal coming in 1.74% lower than expected, while Charlotte, North Carolina, actually had an average appraisal coming in at 1.99% higher than expected.

“An appraisal can cause a variety of emotions from curiosity of the value, to frustration if it comes in too low and even surprise if the appraised value shows more equity than the homeowner realized,” said Bill Banfield, Quicken Loans EVP of Capital Markets.

“Luckily there wasn’t a lot of frustrated homeowners in May since the HPPI values across the country are in a relatively tight band, showing that appraisals are not likely to cause much of a disruption in the mortgage process,” Banfield continued. “This is, however, a reminder to homeowners that they should always keep an eye on the home sales around them to get a realistic gauge of their home value before estimating what it could be.”

Home values rose 3.54% year over year across the country, according to the index, with all regions continuing to see annual appraisal values increase.

But on a month-over-month basis, the Midwest was the only region with home value growth, posting a 0.47% gain.

“Winter’s long hibernation is definitely over for Midwest homebuyers. They’re hitting the streets and competing for a persistently low home inventory which is leading to appraisal value spikes,” Banfield said. “The annual increase is a very positive sign, showing the growth is more than just seasonality.”