Some might say that so far, 2019 is looking to be the year of the iBuyer. The term has exploded across the internet as major companies like Redfin and Zillow expand their reach into the business of buying homes directly from sellers.

What's an iBuyer? It's an online real estate investor who seeks to reduce transactional property costs via digital tools, minimizing the involvement of real estate agents in favor of their own online listing services. (For more on this, check out Editor-in-Chief Jacob Gaffney's article, WTH is an iBuyer?).

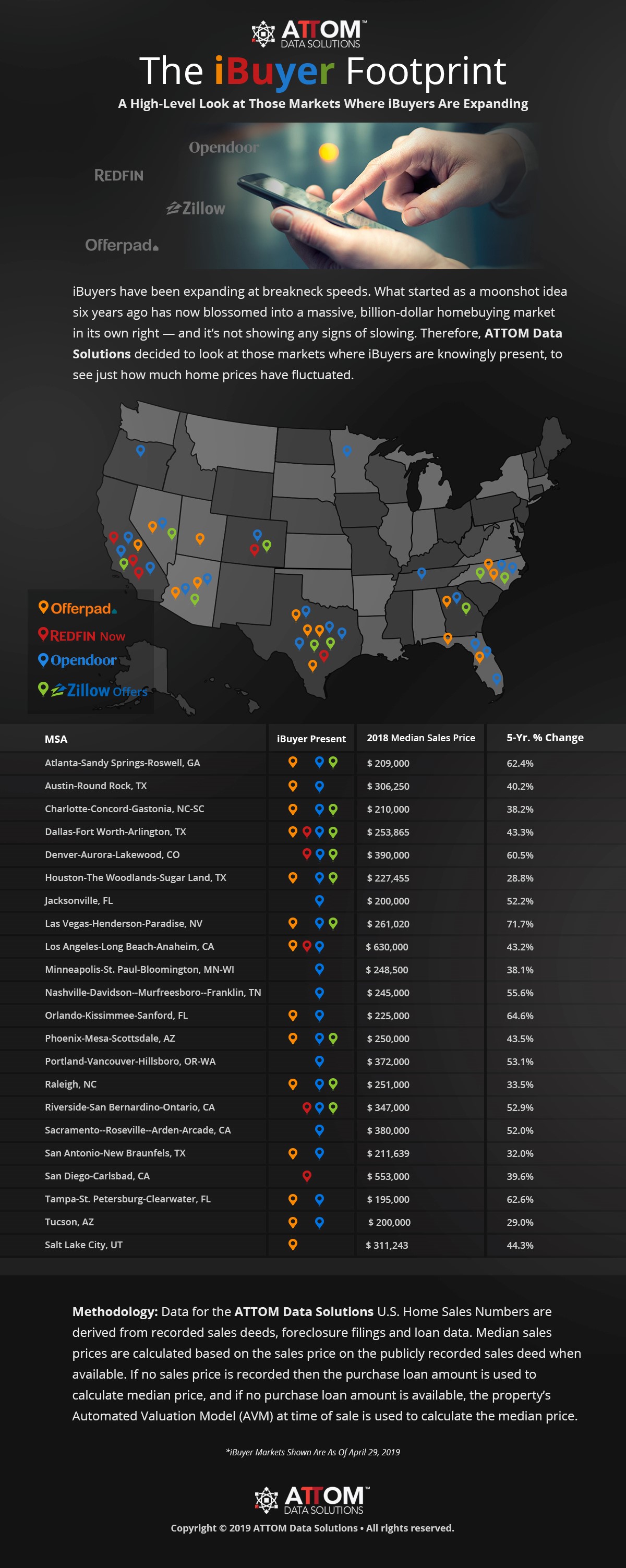

A recent report from ATTOM Data Solutions takes a deep dive into the iBuyer phenomenon, offering an up-close look at where they operate and where they’re headed next.

The concept was first launched by Opendoor in 2014, and then picked up by Offerpad before a number of others – including the big names above – jumped on board, ATTOM notes.

“iBuyers have been expanding at breakneck speeds,” writes ATTOM CTO Todd Teta. “What started as a moonshot idea six years ago has now blossomed into a massive, billion-dollar homebuying market in its own right – and it’s not showing any signs of slowing.”

Teta notes that most major iBuyers started out in Phoenix, but their reach quickly expanded to other markets in the South and beyond. While Phoenix remains the iBuyer hub, Texas, North Carolina, Florida, California and Georgia also have strong iBuyer activity.

Teta points out that iBuyers have, for the most part, shied away from North and Northeast markets – likely a result of low housing inventory and a lack of affordability, as well as a general lack of consistency in housing stock.

“iBuyers rely heavily on data and algorithms when evaluating potential properties,” Teta notes. “Areas with inconsistent and highly unique housing makes this approach less reliable (and less profitable).”

Teta predicts this year will see continued action in Southern and suburban markets, and with the recent wave of sizable institutional investments in companies operating in this space, we can expect to see the iBuyer market continue impressive trajectory.

These are the cities where the major iBuyers are operating right now, according to ATTOM:

Opendoor

Arizona: Phoenix, Tucson

California: Sacramento, Riverside, Los Angeles

Colorado: Denver

Florida: Tampa, Orlando, Jacksonville

Georgia: Atlanta

Nevada: Las Vegas

North Carolina: Charlotte, Raleigh-Durham

Oregon: Portland

Minnesota: Minneapolis-St. Paul

Tennessee: Nashville

Texas: Austin, Dallas-Fort Worth, Houston, San Antonio

Offerpad

Arizona: Phoenix, Tucson

California: Los Angeles

Florida: Orlando, Tampa

Georgia: Atlanta

Nevada: Las Vegas

North Carolina: Charlotte, Raleigh

Texas: Austin, Dallas-Fort Worth, Houston, San Antonio

Utah: Salt Lake City

Zillow Instant Offers

Arizona: Phoenix

California: Riverside

Colorado: Denver

Georgia: Atlanta

Nevada: Las Vegas

North Carolina: Charlotte, Raleigh

Texas: Dallas-Fort Worth, Houston

Redfin Now

California: San Diego, Los Angeles, Inland Empire

Colorado: Denver

Texas: Dallas-Fort Wort

Here is an infographic from ATTOM that illustrates the current iBuyer footprint: