Mortgage rates have fallen just as spring home buying season begins to heat up, according to the latest Freddie Mac Primary Mortgage Market Survey.

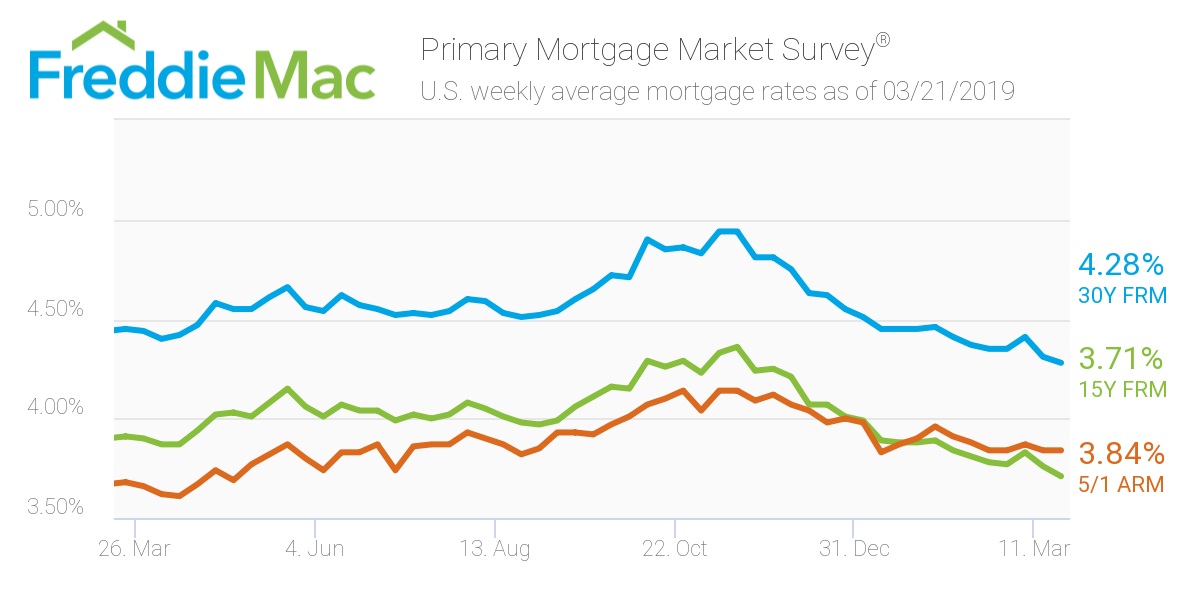

The 30-year fixed-rate mortgage averaged 4.28% for the week ending March 21, 2019, according to the survey, falling from last week's rate of 4.31%.

Once again, this week’s rate is moderately lower than last year’s rate of 4.45%.

“Mortgage rates have dipped quite dramatically since the start of the year and house prices continue to moderate, which should help on the homebuyer affordability front,” Freddie Mac Chief Economist Sam Khater said. “The combination of improving affordability and more inventory than the last few spring selling seasons should lead to improved home sales demand.”

The 15-year FRM averaged 3.71% this week, slidng from last week’s 3.76%. Notably, the 15-year FRM was significantly higher than last year’s rate of 3.91%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.84%, holding its ground from last week’s rate. However, this rate is still higher than the same time period in 2018, when it averaged 3.68%.

(Click to enlarge)