After falling for three consecutive weeks, mortgage interest rates remained virtually stagnant, according to the latest Freddie Mac Primary Mortgage Market Survey.

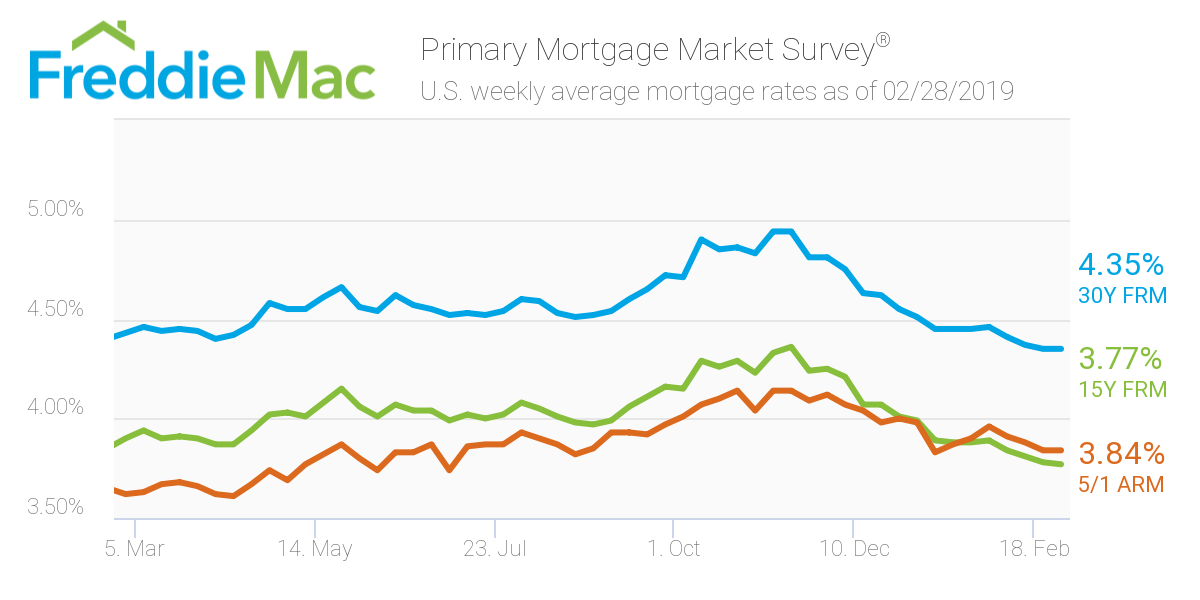

The 30-year fixed-rate mortgage averaged 4.35% for the week ending Feb. 21, 2019, according to the survey, holding steady from last week's level.

However, this week’s rate is moderately lower than last year’s rate of 4.43%.

“Mortgage rates remained mostly unchanged this week, while mortgage applications rose 5.3% from the previous week,” Freddie Mac Chief Economist Sam Khater said. “The general decline in rates we have seen recently, combined with rebounding pending home sales, hint at a strong spring homebuying season.”

The 15-year FRM averaged 3.77% this week, inching backwards from last week’s 3.78%. This time last year, the 15-year FRM was 3.9%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.84%, holding its ground from last week’s rate. Notably, the rate remains moderately higher than the same time period in 2018, when it averaged 3.62%.

(Click to enlarge)