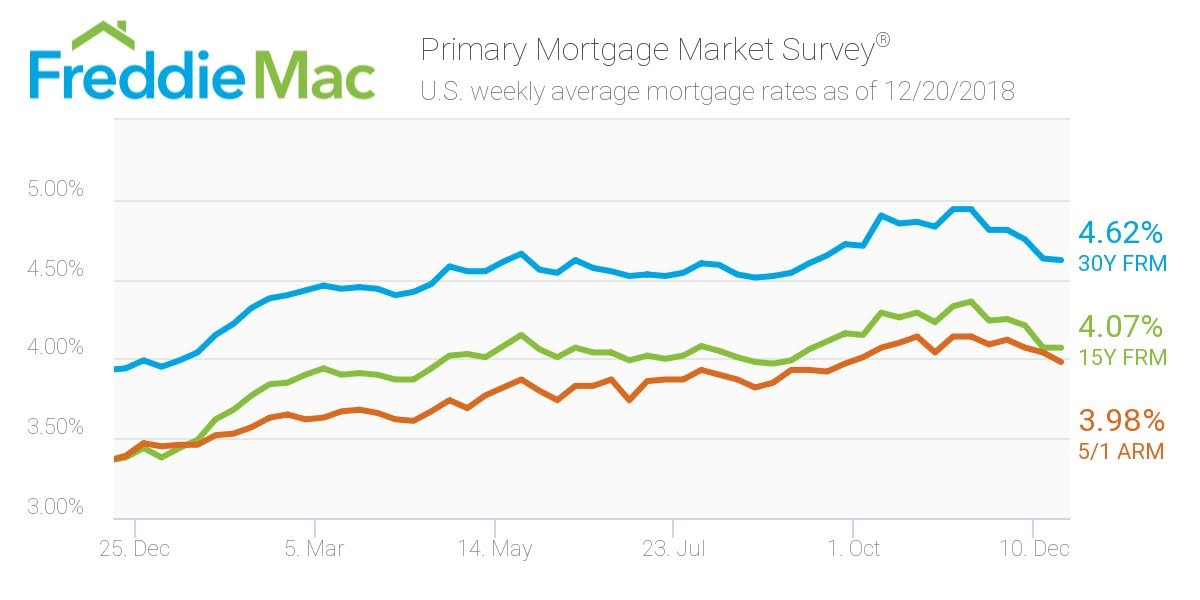

After reaching a three-month low last week, mortgage rates cooled off further, according to the latest Freddie Mac Primary Mortgage Market Survey.

According to the survey, the 30-year fixed-rate mortgage inched backwards from 4.63% last week, averaging 4.62% for the week ending Dec. 20, 2018. This is still a significant increase from last year’s rate of 3.94%.

Freddie Mac Chief Economist Sam Khater said the response to the recent decline in mortgage rates is already being felt in the housing market.

“After declining for six consecutive months, existing home sales finally rose in October and November and are essentially at the same level as during the summer months,” Khater continued. “This modest rebound in sales indicates that homebuyers are very sensitive to mortgage rate changes – and given the further drop in rates we’ve seen this month, we expect to see a modest rebound in home sales as well.”

(click to enlarge)

The 15-year FRM averaged 4.07% this week, holding steady from last week’s average. This time last year, the 15-year FRM was 3.38%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.98%, retreating from 4.04% the week before. However, the rate is still higher than this time last year when it averaged 3.39%.