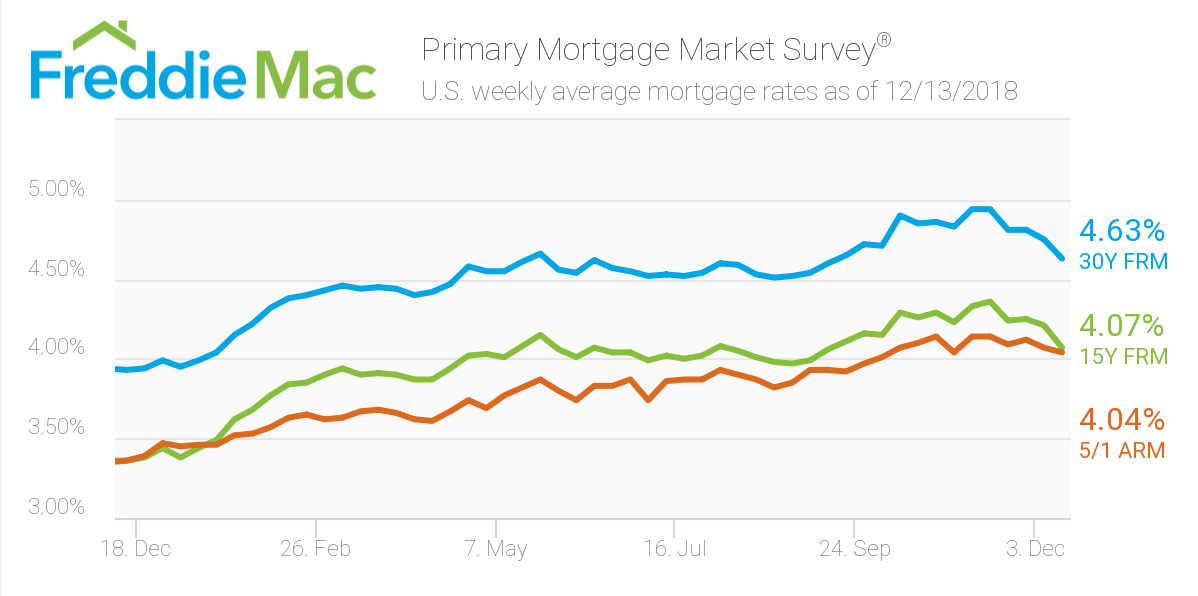

Mortgage rates have now reached a three-month-low, according to the latest Freddie Mac Primary Mortgage Market Survey.

According to the survey, the 30-year fixed-rate mortgage retreated from 4.75% last week, averaging 4.63% for the week ending Dec. 13, 2018. Notably, this is still an increase from last year’s rate of 3.93%.

Freddie Mac Chief Economist Sam Khater said the 30-year fixed fell to 4.63% this week – the lowest it has been since mid-September.

“Mortgage rates have either fallen or remained flat for five consecutive weeks and purchase applicants are responding with an uptick in demand given these lower rates,” Khater said. “While the housing market softened in response to higher rates through most of this year, the combination of a low unemployment and recent downdraft in rates should support home sales heading into the early winter months.”

(click to enlarge)

The 15-year FRM averaged 4.07% this week, tumbling from last week's 4.21%. This time last year, the 15-year FRM was 3.36%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 4.04%, declining from 4.07% the week before. It remains significantly higher than this time last year when it averaged 3.36%.