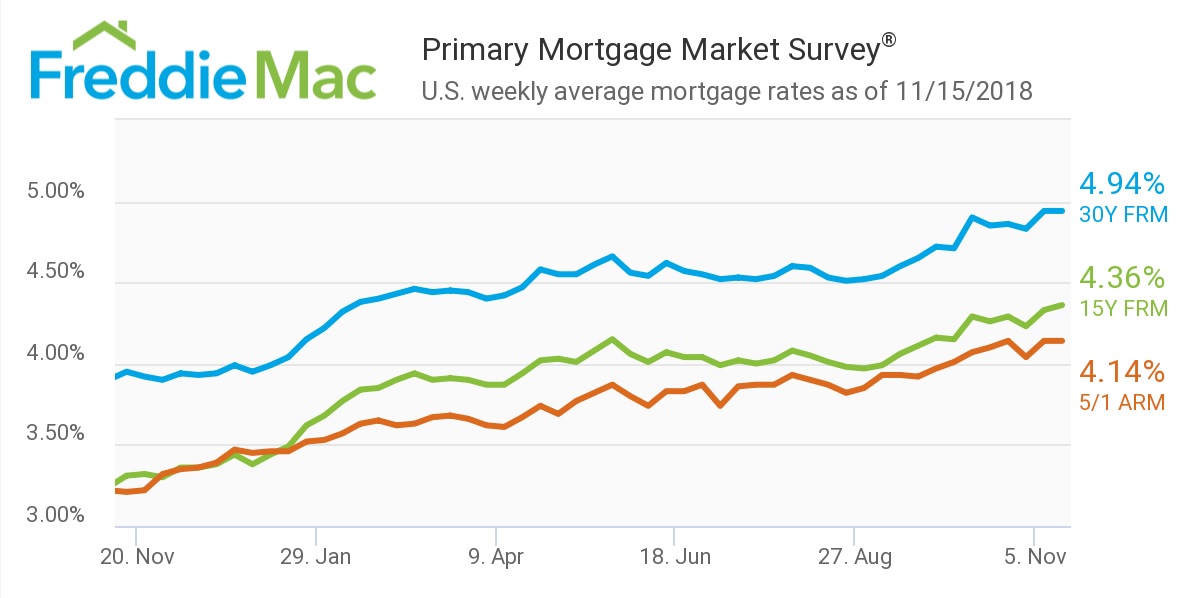

Mortgage rates held steady this week, moderately increasing, according to Freddie Mac’s latest Primary Mortgage Market Survey.

According to the survey, the 30-year fixed-rate mortgage remained unchanged from last week, averaging 4.94% for the week ending Nov. 15, 2018. Notably, this is still an increase from last year’s rate of 3.95%.

Freddie Mac Chief Economist Sam Khater said despite recent market volatility, mortgage rates remained steady this week.

“The stability in mortgage rates reflects the moderation in inflationary pressures in the economy due to lower oil prices and subdued wage growth,” Khater said. “On the margin, lower energy costs are a positive for the home sales market, particularly for lower-middle income suburban buyers who spend proportionately more income on transportation costs.”

(click to enlarge)

The 15-year FRM averaged 4.36% this week, rising from last week's 4.33%. This time last year, the 15-year FRM was 3.31%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage also held its ground, staying at 4.14% from the week before. Once again, it remains much higher than this time last year when it averaged 3.21%.