The homeownership rate increased slightly in the third quarter, driven primarily by a jump in first-time homebuyers.

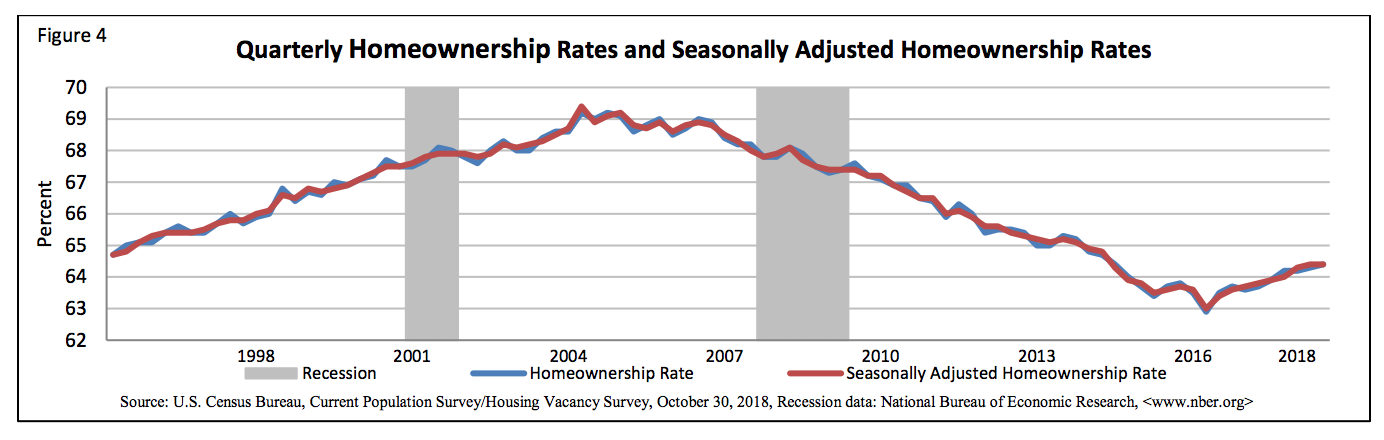

The homeownership rate increased to 64.4% in the third quarter of 2018, according to the latest report from the U.S. Census Bureau. This is up slightly from 64.3% in the second quarter and from 63.9% in the third quarter of 2017.

Click to Enlarge

(Source: U.S. Census Bureau)

This increase was driven primarily by first-time homebuyers as more Millennials opted out of renting and entered into the homeownership market.

“Led by another surge in owner household formation, homeownership rates are up again, but those gains are not driven by those who experienced the housing crash and lived to tell about it,” said Skylar Olsen, Zillow director of economic research and outreach. “First-time home buyers drove the market this year.”

“The homeownership rate of the 45 to 55 age bracket dropped quarter-over-quarter, while the under 35 age bracket continues to rally,” Olsen said. “Their homeownership rate is up a whopping 1.2% since Q3 2017 to 36.8%.”

Homeownership among those under age 35 increased from 35.6% in the third quarter 2017 and 36.5% in the second quarter this year to 36.8% in the third quarter 2018, the report showed.

Meanwhile, those ages 35 to 44 years dropped from 60% in the second quarter to 59.5% in the third quarter. This is still up slightly from 59.3% in the third quarter 2017. Those ages 45 to 54 years also saw a decrease, falling from 70.6% in the second quarter to 69.7% in the third. This is also still up from 69.1% in the third quarter of 2017.

Older generations also saw an increase in their homeownership rate. The rate for those ages 55 to 64 increased from 75.1% the previous quarter and 75% the previous year to 75.6% in the third quarter. Those ages 65 years and older saw an increase from 78% in the second quarter to 78.6% in the third quarter this year, however this is down slightly from 78.9% in the third quarter of 2017.

“Today’s report shows that more people are choosing homeownership over renting, and a large part of that story is the historically large number of first-time homebuyers,” said Tian Liu, Genworth Mortgage Insurance chief economist. “In the past two years, first-time homebuyers have purchased at least 1.9 million homes each year. That is more than the pace of household formation over the same period, meaning that the transition from renting to own is the more powerful driver of housing demand.”

“That has also been an important and often overlooked reason for the rapid rise in home prices, as more buyers came into the market,” Liu said. “Paradoxically, the rise of first-time homebuyers, which has pushed home prices up, also is slowing home sales today. These events caused the homeownership rate and home sales to diverge this quarter.”

The Hispanic homeownership rate saw a quarterly drop as it fell from 46.6% in the second quarter to 46.3% in the third quarter. This was still up slightly from 46.1% in the third quarter of 2017.

Among whites, the homeownership rate increased from 72.5% in the third quarter of 2017 and 72.9% in the second quarter this year to 73.1% in the third quarter of 2018. Blacks also saw an increase from last quarter, rising from 41.6% to 41.7%, however the rate dropped from last year’s 42%.

The national vacancy rate increased just 0.1 percentage point from the second quarter to 1.6% in the third quarter.