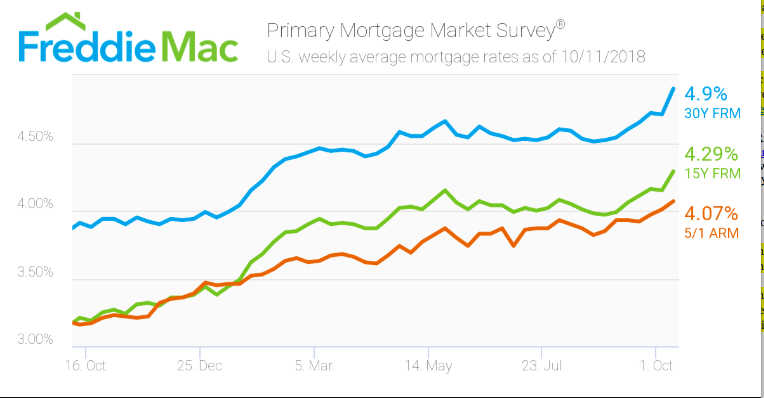

After weeks of climbing, mortgage rates have now risen to their highest level in seven years, according to Freddie Mac’s latest Primary Mortgage Market survey.

Freddie Mac Chief Economist Sam Khater said rates are now at their highest level since the week of April 14, 2011.

According to the Primary Mortgage Market survey, the 30-year fixed-rate mortgage averaged 4.9% for the week ending Oct. 11, 2018, increasing from 4.71% last week, and significantly higher than last year’s rate of 3.91%.

“Rising rates paired with high and escalating home prices is putting downward pressure on purchase demand,” Khater said. “While the monthly payment remains affordable due to the still low mortgage rate environment, the primary hurdle for many borrowers today is the down payment and that is the reason home sales have decreased in many high-priced markets.”

(Source: Freddie Mac)

The 15-year FRM averaged 4.29% this week, moving forward from last week's 4.15%. This time last year, the 15-year FRM was 3.21%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage moved to 4.07% this week, moderately increasing from 4.01% last week. This is substantially higher than this time last year when it averaged 3.16%.