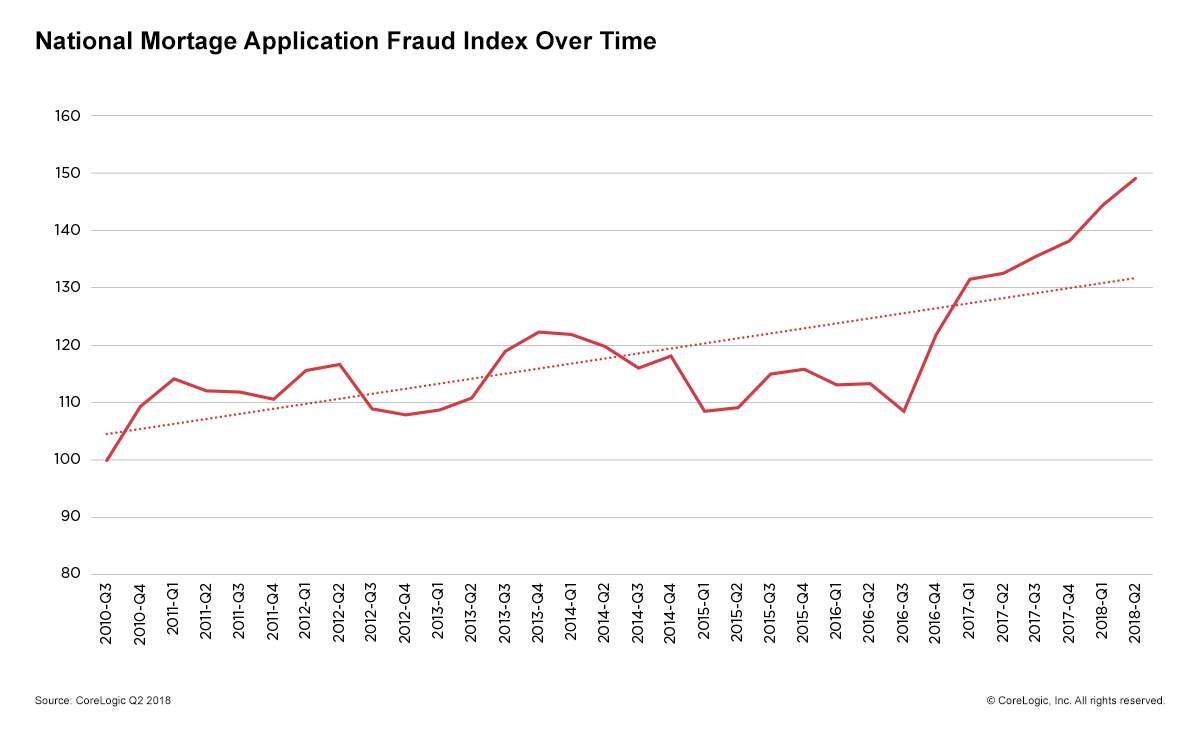

There was a significant increase in mortgage fraud risk at the end of the second quarter of 2018, according to Corelogic’s latest Mortgage Application Fraud Risk Index.

According to the Mortgage Fraud Report, there was a 12.4% year-over-year increase in fraud risk at the end of the second quarter of 2018.

The Mortgage Fraud Report analyzes the collective level of loan application fraud risk experienced in the mortgage industry each quarter.

The report is based on residential mortgage loan applications processed by CoreLogic LoanSafe Fraud Manager and includes data for six fraud type indicators that complement the national index: identity, income, occupancy, property, transaction and undisclosed real estate debt.

CoreLogic’s Principal of Fraud Solutions Strategy Bridget Berg said this year’s trend continues to show an increase in mortgage fraud risk year-over-year.

“Because home prices are rising, and demand is strong, most mortgage fraud in this type of market is motivated by bona fide borrowers trying to qualify for a mortgage,” Berg said. “Undisclosed real estate liabilities, credit repair, questionable down payment sources and income falsification are the most likely misrepresentations.”

Earlier this month, Fannie Mae issued a warning to lenders, cautioning them of more than 30 employers that were showing up on borrowers’ mortgage documentation that appeared to be fake.

(Source: Corelogic)

The report indicated that during the second quarter of 2018, an estimated 0.92% of all mortgage application contained indications of fraud, increasing from 0.82% in the second quarter of 2017.

According to the report, all of the top 10 riskiest states showed an increase in risk from the previous years. In particular, New York, New Jersey and Florida continue to be the top three states for mortgage application fraud risk, retaining the same positions as the previous year.

The states with the greatest year-over-year risk growth included New Mexico, Mississippi, Illinois, Oklahoma and Texas. Notably, New Mexico, Illinois and Oklahoma now have risk levels greater than the National Index, growing from 133 to 149 year-over-year.