Fannie Mae reported Thursday it posted a comprehensive income of $4.5 billion in the second quarter of 2018, which was primarily driven by an increase in credit-related income due to the redesignation of loans from held-for-investment to held-for-sale.

This income is up slightly from the first quarter this year, when the company reported comprehensive income of $3.9 billion, and up even more from the second quarter of 2017, when it saw a comprehensive income of $3.1 billion.

The increase was partially offset by lower fair value gains in the second quarter of 2018 compared with the first quarter of this year.

The company’s net income came in at $4.5 billion for the quarter, up from $4.3 billion in the first quarter this year.

The company also stated its pre-tax income was $5.6 billion for the second quarter of 2018, up from $5.4 billion for the first quarter.

Notably, Fannie Mae announced it provided $125 billion in liquidity to the mortgage market through financing and refinancing 665,000 homes.

A total of $111 billion in liquidity was awarded to the single family mortgage market, which is an estimated market share of 6% for the second quarter of 2018.

The company also provided $14.5 billion in multifamily financing in the second quarter of 2018.

In the second quarter of 2018, housing sales slightly declined compared with the first quarter of 2018.

Fannie Mae states total existing home sales averaged 5.4 million units annualized in the second quarter of 2018, compared with 5.5 million units in the first quarter of 2018, according to the National Association of Realtors.

Fannie Mae said new single-family home sales decreased during the second quarter of 2018, averaging an annualized rate of 646,000 units down from 656,000 units in the first quarter of 2018, according to the U.S. Census Bureau.

Fannie Mae forecasts that total originations in the U.S. single-family mortgage market in 2018 will decrease 8% from 2017 from estimated $1.83 trillion in 2017 to $1.69 trillion in 2018.

Fannie Mae also estimates that refinancing originations in the U.S. single-family mortgage market will decrease from an estimated $650 billion in 2017 to $481 billion in 2018.

The GSE will now pay out $4.5 billion to the U.S. Treasury if the Federal Housing Finance Agency agrees to a dividend in this amount. In May, Fannie Mae paid out 938 million to the Treasury.

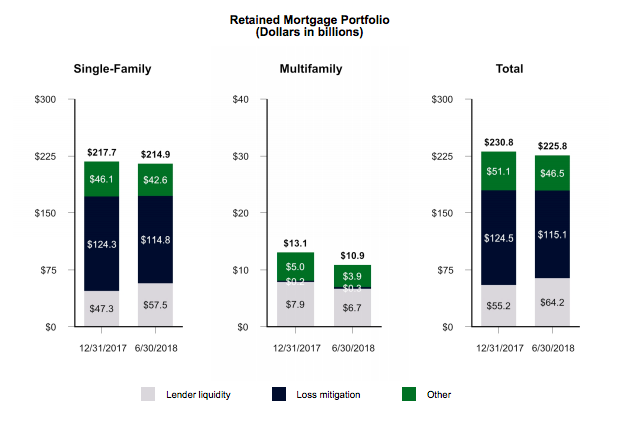

The chart below separates retained mortgage portfolio, measured by lender liquidity, loss mitigation and previously purchased investments.