The U.S. Census Bureau released a 2010 Census Brief that highlights the nation's changing age composition and the growth of older age segments.

From 2000 to 2010, the number of Americans aged 65 and older grew by 15% to top 40 million people. This group now accounts for 13% of the total population. The next segment, those from 45 to 64 grew by 35%, or just under 82 million, making up 26% of the total population.

Further demonstrating the nature of the aging population, the 18 to 44 age group only grew by 0.6% in the same period, amounting to 36.5% of the total at 112.8 million. Those under 18 comprised 24% of the total at 74.2 million, a 2.6% growth in the period.

The data confirms what many industry participants have pointed to as positive opportunity trends for the reverse mortgage sector. As the number of reverse mortgage eligible Americans grows, so will the need to identify additional ways to fund retirement ways beyond the traditional methods, such as Social Security.

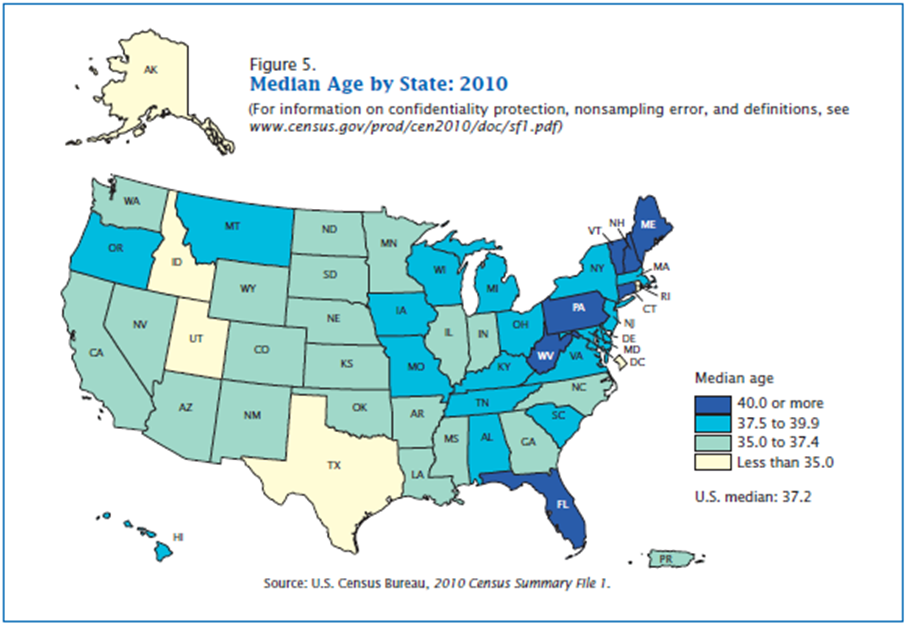

The median age increased between 2000 and 2010 from 35.3 to 37.2. The increase is contributed to the aging baby boomer population and the longer life expectancies. All 50 states experienced an increase in the median age, with only the District of Columbia experiencing a decline.

Seven states reported a median age over 40 in the 2010 census. Maine at 42.7 had the highest median age, followed by Vermont (41.5), West Virginia (41.3), New Hampshire (41.1), Florida (40.7), Pennsylvania (40.1) and Connecticut (40.0).