The Consumer Financial Protection Bureau (CFPB) released their first draft of the new combined Truth in Lending and Good Faith Estimate mortgage disclosure forms and invited consumers and industry participants to provide feedback to the bureau.

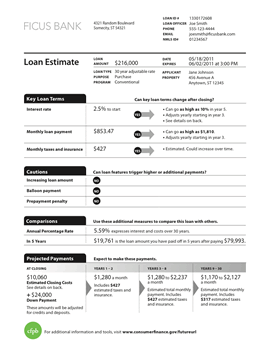

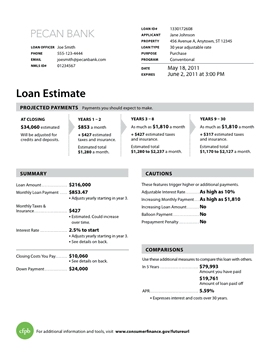

With a goal of providing a single disclosure that is more effective in providing the information necessary for a consumer to review the terms of a proposed loan, the CFPB has presented two different options to accomplish that goal.

The links to the above documents connect to the industry participants feedback section. There is also a link for consumers to provide feedback on the "Know Before Your Owe" page.

"With a clear, simple form, consumers can better answer two basic questions: 'Can I afford this mortgage, and can I get a better deal somewhere else?'" Elizabeth Warren, the White House's special adviser in charge of setting up the CFPB, said in announcing the release of the drafts.

In helping to guide the comments back the CFPB has suggested three questions for respondents to consider as they review the forms:

- Would this form help consumers understand the true costs and risks of a mortgage?

- Could lenders and brokers clearly and easily explain the form to their customers?What would you like to see improved on the form?

- Is there some way to make things a little bit clearer?

In a statement, the Mortgage Bankers Association expressed support for disclosures that make mortgages easier to understand, but warned about unintended consequences.

“Making mortgages easier to understand for prospective borrowers has been a long term priority for the mortgage industry and we are pleased to see the initial prototypes take a step in that direction," said David Stevens, MBA President and CEO. "One of the challenges this effort inevitably faces is trying to strike the right balance between simplification and providing as much information as possible to help borrowers make the most informed choices. Previous attempts at revising the forms have struggled with this paradox and this is going to be a focus of everyone involved in this effort"

The statement also said that the transition to the new forms must be implemented without considerable cost or disruption to lenders since it is ultimately the borrower who bears those costs.

The CFPB did not set a timetable for this review process, but stated that this first step in the process will last months and will include additional opportunities to provide feedback as the drafts evolve.