Does it feel like the rent is too damn high? That’s because, according to Trulia, it is.

Trulia’s latest rental analysis shows median rent increased 3.1% in 2017 with much higher increases experienced in four major metro areas.

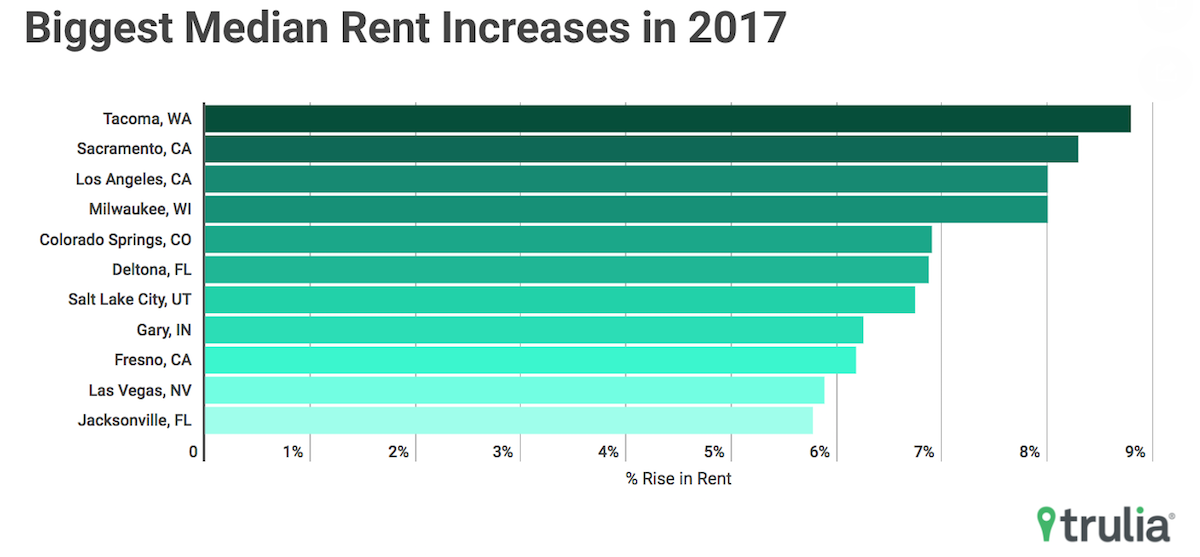

Comparing 2016 to 2017, the biggest median rent increases were experienced in already strained housing markets. Tacoma, Washington, saw the largest increase, jumping 8.8% from the 2016 median rent of $1,650 to $1,795, while Sacramento’s median rent increased 8.3% from $1,750 in 2016 to $1,895 last year. Milwaukee and Los Angeles both saw 8% increases in median rent, based on Trulia’s estimates.

Additionally, the company’s analysis shows the markets in the West have led the country in rent increases, as seven of the Top 10 metros experiencing the biggest rent increases are located in the Western U.S.

Take a look at Trulia's graph showing the increases:

(Click to enlarge, image courtesy of Trulia)

Overall, rent has increased 19.6% since the end of 2012, the year housing prices bottomed, Trulia explained in its blog post, adding that rent prices across the country mostly have trailed housing price increases.

California rents increased the most since 2012 with the cities of Oakland, San Jose, San Francisco and Sacramento ranking in the Top 10 for rent increases during the five-year period, Trulia wrote.

From Trulia’s analysis:

“Rising rents may come as somewhat of a surprise. After all, the number or households renting has been declining while homeownership increased, and rent increases have slowed somewhat in the last year compared to the last five years.

Since the end of 2012, the year housing prices bottomed amid the crash, rents have increased 19.6% nationally. But again, if you’re unfortunate enough to live in a few hot housing markets, you’re feeling more pain. Places like Cape Coral-Fort Myers, Fla., and Oakland, Calif., have seen increases of more than 50% since the end of the Great Recession.”