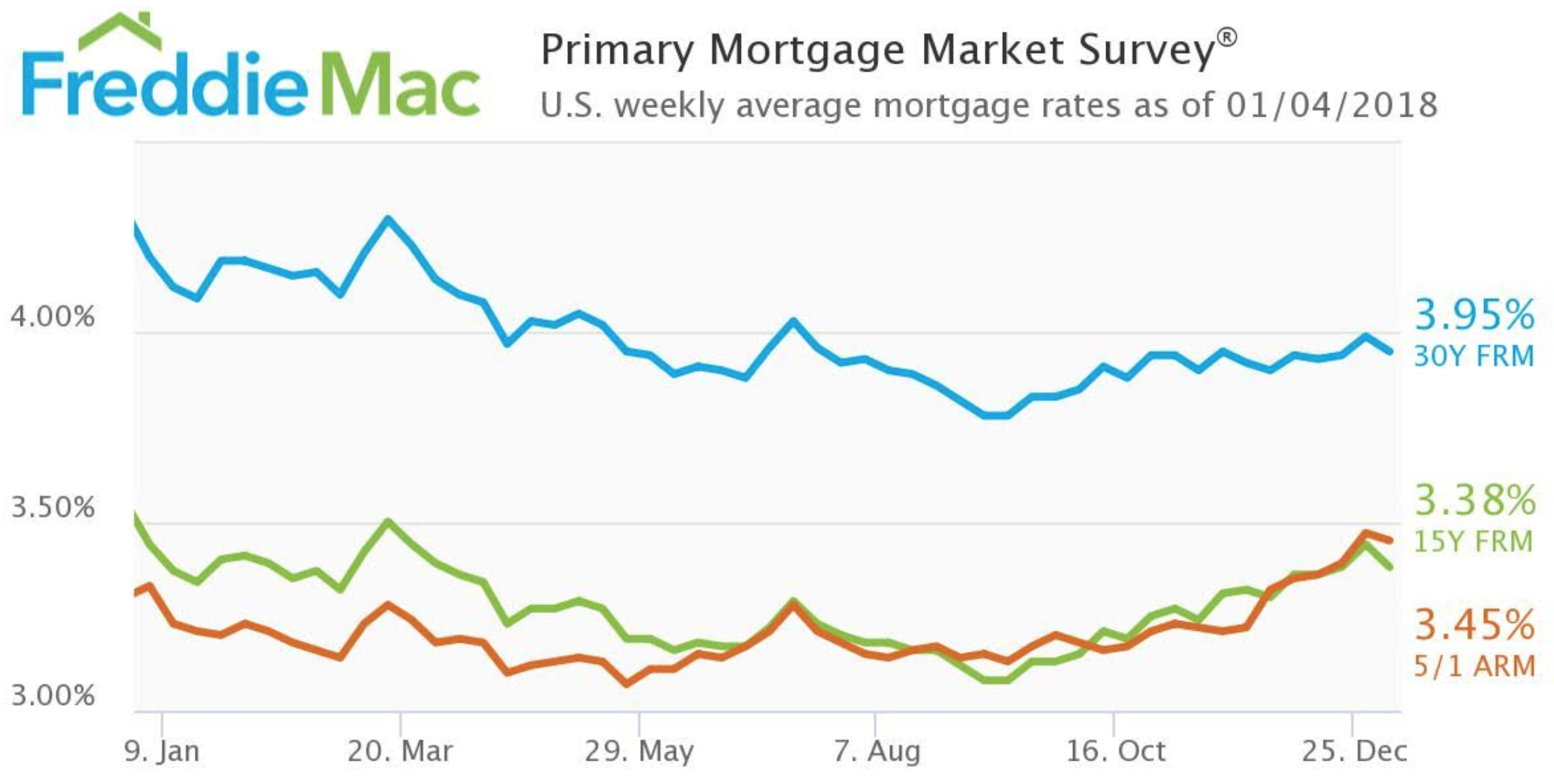

Mortgage rates decreased at the start of the year as they felt less upward pressure from the market, according Freddie Mac’s Primary Mortgage Market Survey.

“With the FOMC minutes showing continued support for gradual increases in policy rates from many participants and inflation rates remaining low, there isn’t much upward pressure on long-term rates at the moment,” said Len Kiefer, Freddie Mac deputy chief economist. “Whether that changes due to a tighter labor market and the economic impact of tax reform remains to be seen.”

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed-rate mortgage dropped to 3.95% for the week ending January 4, 2018. This is down from last week’s 3.99% and down from 4.2% last year.

The 15-year FRM also decreased, falling from 3.44% last week and last year to 3.38% this week.

The five-year Treasury-indexed hybrid adjustable-rate mortgage decreased slightly to 3.45%. This is down from 3.47% last week but up from 3.33% last year.

“Treasury yields fell from a week ago, helping to drive mortgage rates down to start the year,” Kiefer said. “The 30-year fixed-rate mortgage fell four basis points from a week ago to 3.95% in the year’s first survey.”

“Despite increases in short-term interest rates, long-term interest rates remain subdued,” he said. “The 30-year mortgage rate is down a quarter of a percentage point from where it was a year ago and the spread between the 30-year fixed and 5/1 adjustable rate mortgage is the lowest since 2009.”