Housing inventory fell 8.9% from last year in the second quarter of 2017, sending homebuyers scurrying to beat the rising competition.

Housing inventory dropped for nine consecutive quarters, and is currently down a full 20% from inventory levels five years ago, a new report from Trulia shows.

And now, homebuyers are snatching up homes at the fastest pace since Trulia began tracking in 2012. While 57% of homes were still on the market after two months in 2012, today that number shrank down to 47%.

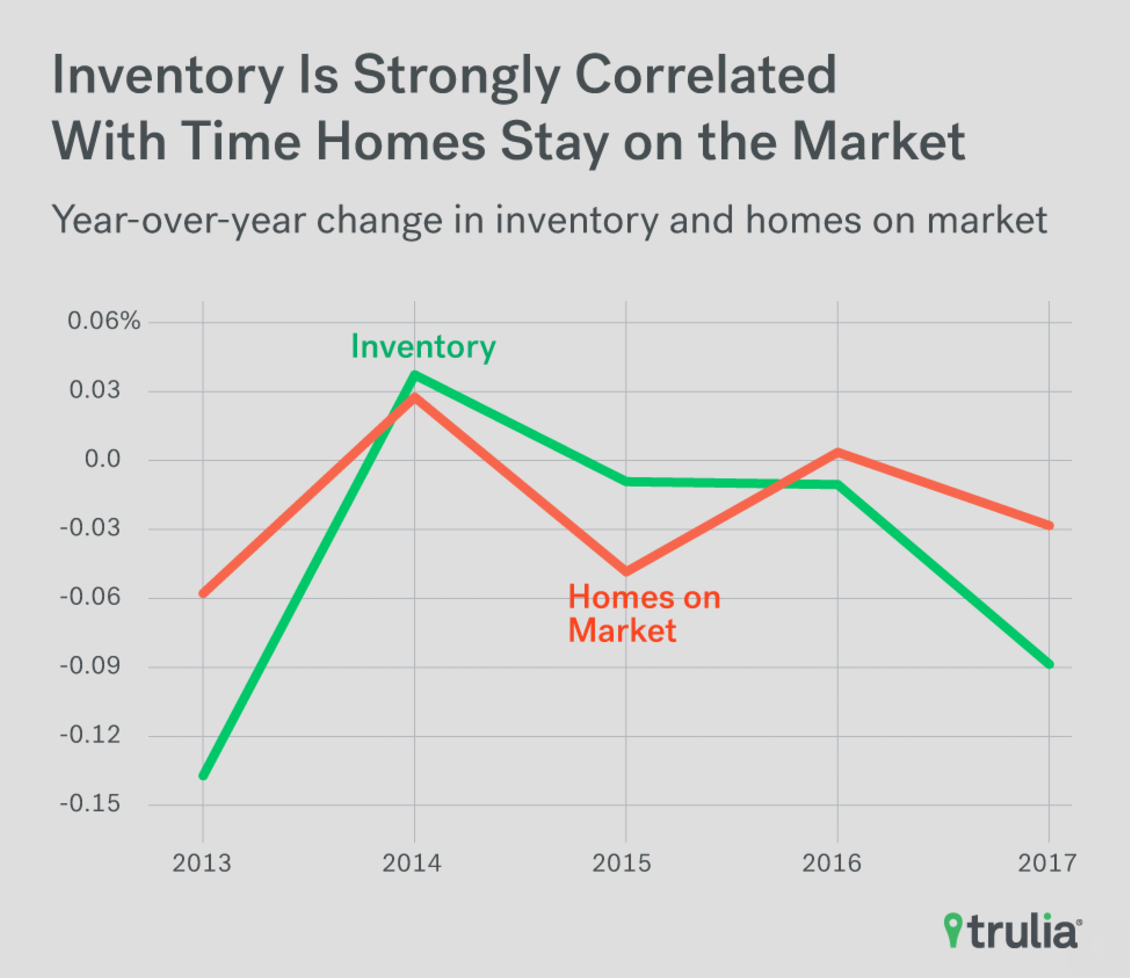

The chart below shows the relationship between housing inventory and the amount of time homes stay on the market.

Click to Enlarge

(Source: Trulia)

Competition is so fierce, in fact, that 33% of Americans who bought a home in the last year made an offer without even seeing the home in person, according to a survey from Redfin, an online real estate brokerage.

This is up from 19% of buyers who placed an offer on a home without seeing it first last year. Among Millennials, even more placed offers without seeing the home in person — a full 41%.

And while that survey showed affordable housing was the most prevalent economic concern, only 5% of homebuyers said they would cancel their home-buying plans if rates surpass 5%.

As supply continues to dwindle, a new report from the National Association of Realtors showed pending home sales dropped for the third consecutive month, possibly a sign that low housing supply is beginning to curb demand.

However, while pending home sales showed a decrease the past few months, existing home sales continue to increase, NAR’s report shows.

But the pending home sales report showed the inventory shortages are hitting hardest in the entry-level housing market, which saw decreased home sales of 7.2% from last year while homes priced at over $1 million saw sales increase by 29.1% from last year.

One expert explained the housing inveventory shortage is having a major impact on the market, and relief is nowhere to be seen.

“Today’s numbers are yet another indication that the lack of homes for sale is having a major, negative impact on the market,” realtor.com Senior Economist Joseph Kirchner said. “The future direction will be brighter if and when we see a significant uptick in inventory, but that unfortunately doesn’t seem to be right around the corner.”

The persistent and disproportional drop in starter and trade-up home inventory is pushing affordability further out of reach of homebuyers, Trulia pointed out in its report. Starter and trade-up homebuyers need to spend 3.1% and 1.7% more of their income than this time last year, whereas premium homebuyers only need to shell out 0.9% more of their income.