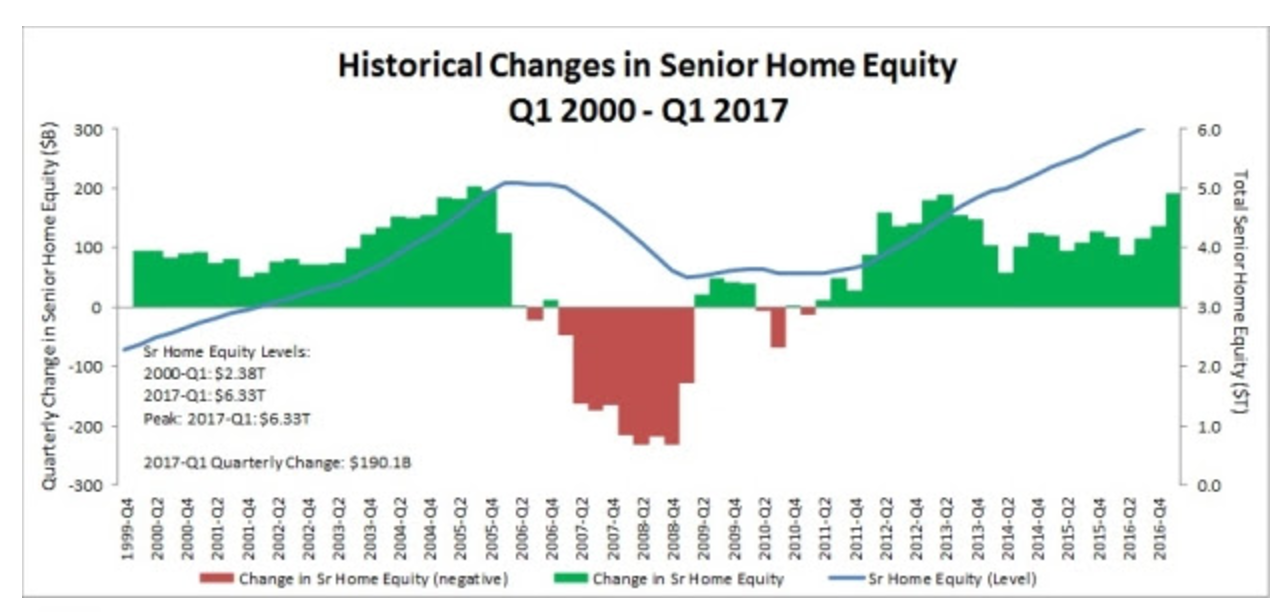

Senior homeowners saw an increase in their home equity in the first quarter of 2017, according to a report from the National Reverse Mortgage Lenders Association.

The report showed homeowners aged 62 and older saw their home equity increase by 3.1% to $6.3 trillion in the first quarter. This is up from $6.13 trillion from the fourth quarter.

This growth in housing wealth for seniors was driven by an estimated 2.6%, or $199.3 billion, increase in senior home values, and was offset by a 0.6% increase in senior-held mortgage debt which totaled $9.2 billion.

Click to Enlarge

(Source: NRMLA)

The NRMLA/RiskSpan Reverse Mortgage Market Index, a quarterly measure of home equity held by older homeowners, increased to 227.07 in the first quarter, an all-time high since the index was first published in 2000.

“Older adults who want to stay in their own homes as they age, and we know a majority do, may find that the house that was perfect for raising a family lacks the features to support aging in place,” NRMLA President and CEO Peter Bell said.

“But, instead of moving out, various modifications, such as stairless entryways and wider bathroom doorframes, can be made to accommodate new mobility and accessibility needs,” Bell said. “The housing wealth our seniors have built up in their homes over the years, their home equity, can be used to update the family house into a space for living comfortably and independently for years to come.”