Mortgage rates increased for the first time in several weeks, but they may not stay up for long if the recent drop in the Treasury yield sticks.

“The 30-year mortgage rate rose two basis points over the week to 3.91%,” Freddie Mac Chief Economist Sean Becketti said. “However, our survey was conducted before investors drove Treasury yields sharply lower in a reaction to the surprisingly weak CPI release.”

“If that drop in yields sticks, mortgage rates are likely to follow in next week’s survey,” Becketti said.

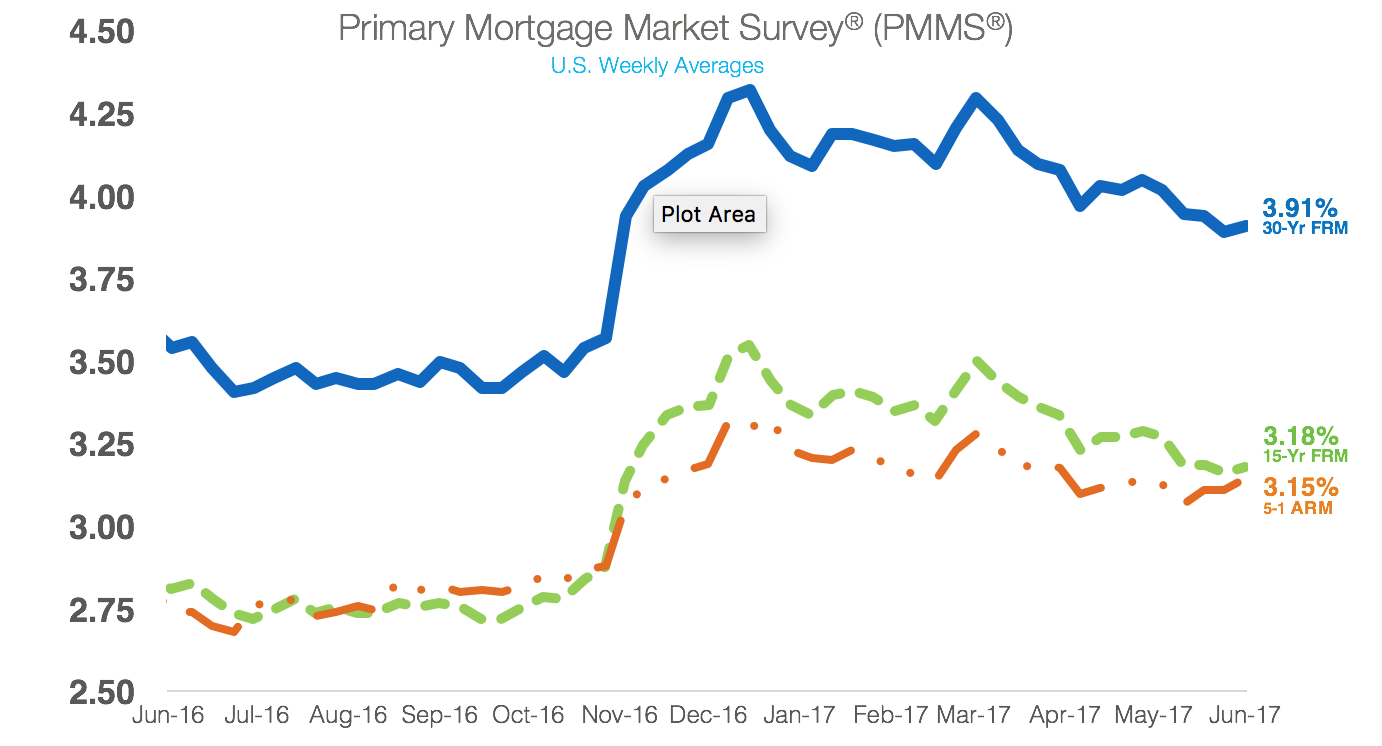

Click to Enlarge

(Source: Freddie Mac)

The 30-year fixed rate mortgage increased to 3.91% for the week ending June 15, 2017. This is an increase from last week’s 3.89% and from last year’s 3.54%.

The 15-year FRM also showed a slight increase from last week’s 3.16% to 3.18%. This is also up from 2.81% last year.

The five-year Treasury-indexed hybrid adjustable-rate mortgage increased to 3.15%. This is up from 3.11% last week and 2.74% last year.