Appraisal volume, to no surprise, tumbled in the latest report due to the Thanksgiving holiday.

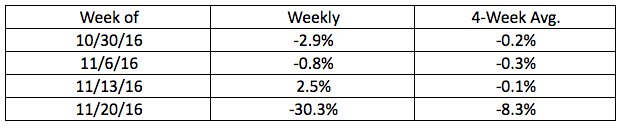

For the week of Nov. 20, appraisal volume plummeted 30.3%, according to the latest National Appraisal Volume Index from a la mode, which is provided exclusively to HousingWire.

However, to put this in perspective, a la mode noted that appraisal volume averages a 30.6% drop for the week, so this year is right in line with expectations.

The significant decline comes after last week’s positive report when appraisal volume finally posted an increase after weeks of decline.

The holiday did skew the 4-week average down to -8.3%, which will take a month to drop off.

Check the chart below to see appraisal volume over the past four weeks.

Click to enlarge

(Source: a la mode)

As a reminder, appraisal volume is an indicator of market strength and holds some advantages over weekly mortgage applications.

For example, fallout is less for appraisals since they are ordered later in the mortgage process, after creditworthiness is determined, and there are few multiple-orders, by the time an appraisal is conducted.