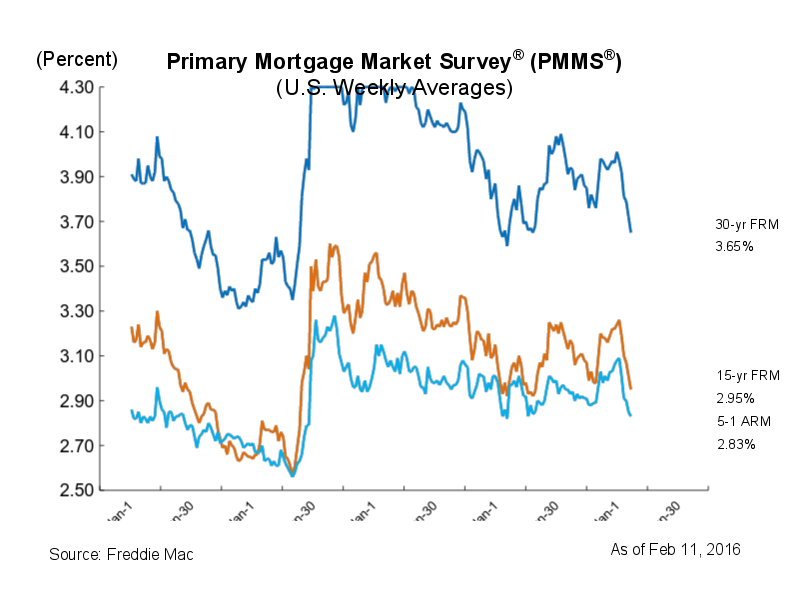

The downward trend in mortgage rates continued for the sixth consecutive week amid ongoing market volatility, the latest results of Freddie Mac’s Primary Mortgage Market Survey found.

The 30-year fixed-rate mortgage dipped to 3.65% for the week ending Feb. 11, 2016, down from last week when it averaged 3.72%. A year ago, the 30-year FRM averaged 3.69%. The average 30-year fixed is now hovering just above its 2015 low of 3.59%.

Also dropping, the 15-year FRM this week averaged 2.95%, down from 3.01% last week. In 2015, the 15-year FRM averaged 2.99%.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage fell to 2.83% this week, a decline from last week’s 2.85%. A year ago, the 5-year ARM averaged 2.97%.

“In a falling rate environment, mortgage rates often adjust more slowly than capital market rates, and the early-2016 flight-to-quality has run true to form,” said Sean Becketti, chief economist with Freddie Mac.

“The 30-year mortgage rate has dropped 36 basis points since the start of the year, while the yield on the 10-year Treasury has dropped 59 basis points over the same period. If Treasury yields were to hold at current levels, mortgage rates might well sink a little further before stabilizing,” he said.

Click to enlarge

(Source: Freddie Mac)