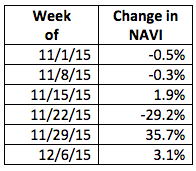

Appraisal volume continued to struggle to recover from the loss it witnessed due to Thanksgiving for the week of Nov. 6, increasing 3.1%, the latest data from a la mode, an appraisal forms software company that tracks appraisal volume throughout the country, said.

While volume jumped 35.7% last week, it fell a bit short of brining the volume up to the levels seen in the week before Thanksgiving.

Click to enlarge

(Source: a la mode)

Kevin Golden, director of analytics with a la mode, explained that the rise prompted by the fear of an imminent rate hike by the Federal Reserve was still not enough to overcome the seasonal slowing, leaving the index still shy of pre-Thanksgiving levels.

The Fed is supposed to announce whether or not it will raise interest rates on Wednesday.

And if rates rise, Golden said that appraisal volume will drop. “Combine this with the seasonal slowdown, it could be a significant amount,” he said. Furthermore, mortgage payments are expected to increase around 12%, by one estimation.

Appraisal volume is an indicator of market strength and has some advantages over mortgage applications. Fallout is less for appraisals since they are ordered later in the mortgage process after credit worthiness has been approved and there are few multiple-orders.

a la mode captures 50% of the appraiser market – more than 6 million appraisals per year since the fourth quarter of 2006.